The Canadian real estate market has been experiencing a significant cooling down in recent months. This trend is characterized by a slump in home sales, a decrease in benchmark prices, and an increase in new listings, particularly in Ontario and Toronto[1][2].

The Slump in Home Sales

The Canadian Real Estate Association (CREA) reported a decline in home sales for three consecutive months, with sales volume inching lower every month since June 2023[1]. This trend is also evident in Toronto, where home sales plummeted by 12% from August and 7.1% year over year[4].

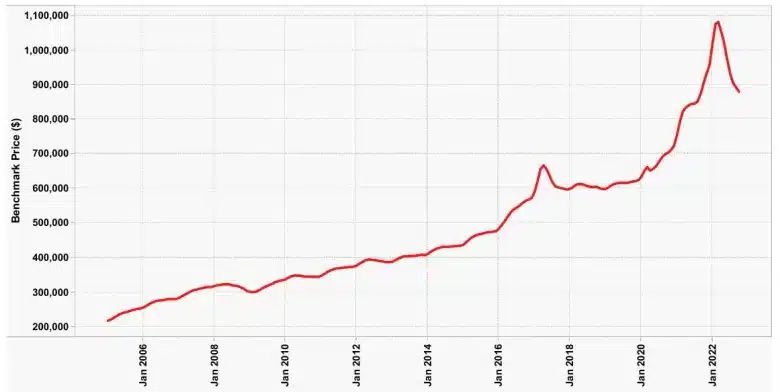

Decrease in Benchmark Prices

The CREA’s national price index slipped by 0.3% during September 2023, marking its first decline since March of the same year[1]. This decrease is primarily due to a sharp slowdown in Ontario, while in most other provinces, prices are still inching higher, albeit at a slower pace[1].

Increase in New Listings

An increase in new listings is another significant trend in the cooling Canadian real estate market. In Toronto, there were 16,258 new listings in September 2023, a 32% increase from August and 44.1% higher than a year ago[4].

The Role of Interest Rates

The rapid escalation in interest rates has been a key factor in the slowing sales trend[1]. Economists agree that the housing market is in for a bumpy ride as long as interest rates remain at their current level[1]. Lower interest rates might be the only thing that could revive Canada’s housing market as supply outpaces demand[4].

The Impact on Sellers and Buyers

The cooling market has led to a vast disconnect between sellers, who are stubbornly trying to get high prices, and buyers looking for a bargain[1]. This disconnect is causing a surge of listings with price changes, indicating that sellers aren’t getting offers at their asking price and are trying to adjust on the fly to attract buyers[1].

The Future of the Canadian Real Estate Market

Despite the current cooling trend, the long-term outlook for the Canadian real estate market is positive[3]. However, the market is expected to remain on the slower side until next year, as buyers seem content to stick to the sidelines until there’s more evidence that interest rates are indeed finally at the top[1].

In conclusion, the Canadian real estate market is currently experiencing a cooling down phase, characterized by a slump in home sales, a decrease in benchmark prices, and an increase in new listings. This trend is largely due to the rapid escalation in interest rates, causing a disconnect between sellers and buyers. However, the long-term outlook for the market remains positive, with the expectation that the market will pick up pace once there’s more evidence that interest rates have peaked.

Citations:

[1] https://www.cbc.ca/news/business/crea-housing-september-1.6994989

[2] https://www.movesmartly.com/articles/as-toronto-housing-market-cools-inventory-builds-october-2023-market-update

[3] https://www.pwc.com/ca/en/industries/real-estate/emerging-trends-in-real-estate.html

[4] https://financialpost.com/real-estate/mortgages/interest-rates-drive-canada-housing-market-coming-months

[5] https://financialpost.com/news/housing-market-could-spur-bank-of-canada-cut-rates-sooner

[6] https://www.noradarealestate.com/blog/toronto-housing-market/

[7] https://www.moneysense.ca/spend/real-estate/whats-affecting-canadas-real-estate-and-housing-market/

[8] https://www.linkedin.com/pulse/dynamic-duo-interest-rates-inflations-impact-torontos-ari-zadegan-laeyc