There are some reasons to be optimism given that housing starts increased dramatically in 2021 in the same year, and the efforts around the nation to tackle the shortage of housing are increasing. In spite of these encouraging signs, we remain convinced that the housing shortage in relation to the needs of the population will continue to exert upward pressure on rents and prices and lower the affordability of housing. There is still a lot to be done by policymakers to close the gap in housing.

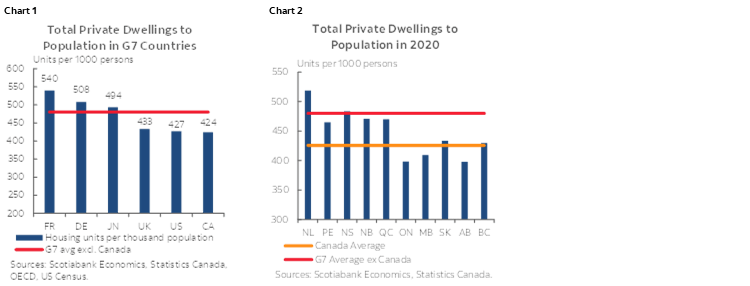

- The housing stock in Canada that is adjusted to population is the lowest among the G7.

- Results differ by provinces within Canada and Canada, and Alberta, Manitoba and Ontario having the lowest numbers of homes per person compared the others provinces.

- Ontario would require more than 650,000 homes to bring its dwellings-to- people to be equal to all of nation

It’s no secret that people who want to buy homes are struggling to find one they can afford. In fact, even people who qualify for loans may still struggle because there aren’t enough houses to choose from! With so few choices, bidding wars are inevitable, making things even more difficult for buyers. So why does the housing market have such little selection? There are a few different reasons Why is Housing Supply So Low in Ontario?

Too many studio and one-bedroom condos

When it comes time to purchase homes in Canada, most Canadians prefer townhouses, semis, and detached homes. They are large and can enjoy a front lawn and a backyard. Although condos do not offer additional outdoor space but they are larger to allow for families. But, the majority of condos in the GTA are built to be used as investment properties. Developers target investors who are able to purchase multiple units at once, and later lease them to young professionals and students.

A family of three or more people can’t reside in a small 400 square foot condominium with a walled kitchen and no private space. The older condos located in Mississauga with more than 1,200 square feet are an ideal option, and there are plenty of families who live there. If you come across an old condo available for auction in Mississauga and you are able to purchase it, do so since it’s the best value for your money!

New Home Construction Fell in the back for a few years

The construction of new homes in single-family houses in the last five decades, and includes the average of long-term housing units built. Builders surpassed that average during the time of the housing bubble. This led to an oversupply of houses on the market, and the value of homes fell. This was among the reasons that led to the housing market crash in 2008.

The rate of construction for new homes has slowed. In the past 13 consecutive years, builders weren’t capable of building enough homes to match what was the average. This underbuilding has left us with an inventory deficit of multiple years that could turn into the epidemic.

The Pandemic’s Impact on the Housing Market

When the pandemic struck the country, it brought a new admiration and renewed appreciation for the importance of the home. The need for a secure place to work, live or study in, as well as exercise was even more crucial for Canadian all over the country. Therefore, when mortgage rates fell to less than 2%, buyers were eagerly entering the market to take advantage of these low rates to secure homes that could meet their ever-changing demands. In the meantime, sellers were reluctant to put their homes for sale as fears regarding the pandemic grew.

Lower mortgage rates

Bank of Canada dropped the mortgage rate from 5 percent to under 2 percent, which led to numerous Canadians to purchase homes. People who are looking to buy homes benefit from record-low rates of interest. The demand grew overnight, but the supply didn’t. The first houses sold at $300k to $400k more than the asking price. Many who did not desire to buy a house considered buying a panic house, believing that the prices would rise more.

Market Report Summary for January 2022

- Average home prices in Ontario have increased by 25.6% in a year to $998,629

- Toronto home prices increased by 24% year-over-year to $1.07M

- Ottawa home prices increased by 15% year-over-year to $677k

- Mississauga home prices increased by 30% year-over-year to $1.15M

- Brampton home prices increased by 41% year-over-year to $1.37M

- Hamilton home prices increased by 35% year-over-year to $976k

Here’s the thing: there are less houses on the market, and this is having a huge effect all across Canada. In fact, inventories are lower than ever before and if you’re thinking about buying in Central Ontario or anywhere else in the country – take notice!

If you are looking for property, there is no better time than now! Housing prices are skyrocketing due to limited supply. Low inventory means that this trend will continue over the next few years, so don’t wait too long!

For more information, please contact me at parveen@teamarora.com or +1 (416) 910-8923.