- The federal government also announced an increase in capital gains taxes to 67% from 50% on June 25th for those earning over $250,000 per annum in capital gains.

- This will be countered by investment in the supply of housing and social programs, to prevent the inheritance of a bigger deficit by younger generations.

- The wealthiest 0.13%, or 12% of Canada’s corporations, as well as individuals with an average income of $1.42 million, will be affected.

- The Lifetime Capital Gains Exemption Limit on Farming and Fishing Properties and Small Business Shares.

- The capital gains tax would be applicable on the disposal of securities, lands, rental properties, or other property such as a cottage.

- An exemption of the capital gain tax applies to the principal residences.

- Critics argue that this could turn off innovation and put the squeeze on professionals’ retirement investments.

- The government defended the move, saying it would only target a few Canadians and will not apply to the sale of the primary residence to create a fair tax system to raise $19.3 billion in the next five years.

Introduction to Capital Gains Tax

The idea of capital gains tax is built on the fact that profits generated from the sale of property aka stocks or property are the subject of taxation. Canada relies quite heavily on this particular system of taxes, which holds a significant weight within the national tax legislation and applies to individuals and entities.

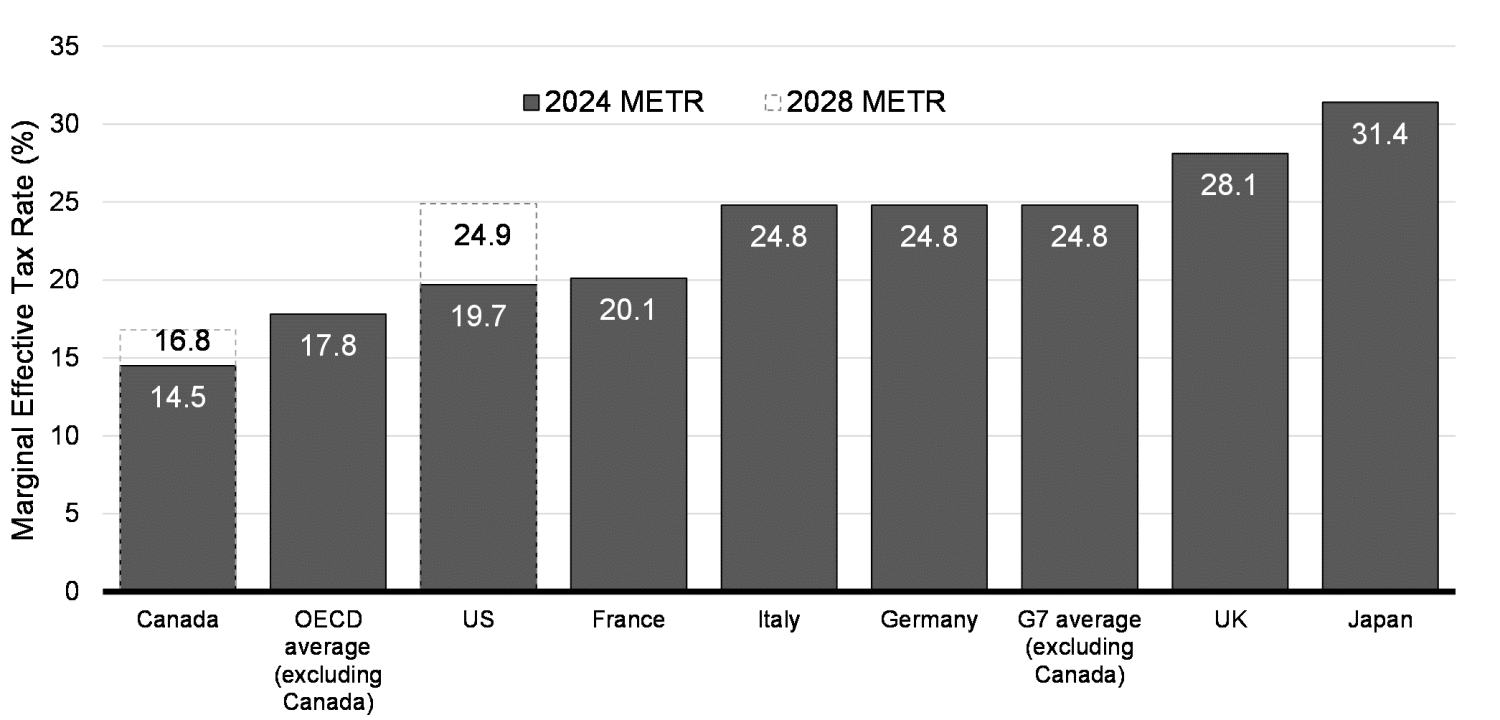

Source: www.canada.ca

Understanding the Importance of G7

G7, comprising seven member countries including Canada, France, Germany, Italy, Japan, the United Kingdom and the European Union (EU), represents a global elite forum of economic collaboration and decision-making. It will hold on the stage as a pro-solution solution to diverse global problems that include money, security, economics and environment. Bearing in mind Canada’s position inside this important organization, the outcome of the G7 deliberations is truly played out in the sense of the domestic policies and economic strategies the country intends to pursue.

Prime Minister Trudeau’s viewpoint

The Prime Minister did nothing to allay fears about the impact that planned changes in the capital gains tax rate would have but simply insisted that these changes were necessary for purposes of equity and equality. He also observed how new measures were going to impact a number of the citizens in the country concerning the sale of secondary property or cottages. The Prime Minister then moved on to stress the protection of primary homes, and particularly how it protects the young people in Canada, considering the terribly difficult market for housing.

“I understand for some people this may cost more if they sell a cottage or a secondary residence. But young people can’t buy their primary residences yet,” Prime Minister Justin Trudeau told reporters Tuesday in Saskatchewan.

Benefits of Changes in Capital Gains Tax

Recommended changes in capital gain taxation will bring fairness into the system and make sure that even the rich are forced to pay their fair share of the taxes. The government hopes to raise more money by increasing the inclusion rate from 50% to 67% for those making annual gains of over $250,000, which would be channeled to important government programs and initiatives such as health, child care, and housing.

Downsides of Proposed Changes to the Capital Gains Tax

The fear among the opposers of the changes is that they might have a bad impact on investment and innovation. Some believe that an increase in the level of capital gains taxes would just discourage investment and play as a drag on economic growth and entrepreneurship, while others opine that it might put specific sections of the business class, such as small business owners and professionals, under extra financial pressure because of the changed tax regime.

Pros of Capital Gains Tax Changes

The proposed changes to capital gains taxation aim to promote fairness within the tax system by ensuring that wealthy individuals and corporations contribute their fair share. By increasing the inclusion rate from 50% to 67% for those with annual gains exceeding $250,000, the government seeks to generate additional revenue to fund essential programs and initiatives, such as healthcare, childcare, and housing.

Cons of Capital Gains Tax Changes

Critics of the proposed changes express concerns about potential adverse effects on investment and innovation. Some argue that higher capital gains taxes could discourage investment, hindering economic growth and entrepreneurship. Additionally, certain groups, such as small business owners and professionals, may face increased financial strain as a result of the altered tax landscape.