Mississauga is Canada’s one of the largest cities. It has become a vibrant economic and cultural hub, and It offers a variety of living experiences through its increasing stock of condos and homes.

About Mississauga

Mississauga is surrounded by beautiful Lake Ontario shorelines, home to many waterfront condos and homes. The old village of Port Credit was transformed into a pedestrian-friendly shopping district. The Square One Shopping Centre is located further north on Hurontario Street, the city’s main thoroughfare. It also houses a large number of corporate headquarters. A string of communities along the Credit River to the west provide a family-friendly, lush living environment. In the city’s northwest corner is the former village of Streetsville. There are also several shopping centers and recreational areas scattered throughout the community.

Mississauga Transportation

MiWay is the city’s transit agency and offers a wide range of bus routes. Many use the Mississauga Transitway, which provides increased frequency and reliability. The Transitway runs approximately from Pearson Airport to Winston Churchill Boulevard via Square One. It is served by both GO Transit or MiWay routes. GO offers rail service to the area. The Lakeshore West runs parallel to Lake Ontario and offers high-quality service seven days per week. The Milton Line runs through the city’s centre and western reaches and offers ten round trips on weekdays. As well, the opening of the Hurontario LRT in 2024 provides transit access for those commuting from north to south in Mississauga. There are four major highways – Highway 401, Highway 403, Highway 407 and Highway 410 – all crossing through the Mississauga city.

If you’re looking to buy your first home, but don’t have the money to get into the market right now, it may be worth your while to look into Mississauga’s many pre-construction condo developments. With the right pre-construction condo, you can get into the market early, take advantage of great savings on your monthly mortgage payment, and build equity as the building itself rises around you. Here are some things to keep in mind if you’re considering getting into the Mississauga pre-construction condo market.

1. Lakeview DXE Club Condos

Developer: Vandyk Properties

Address: 1345 Lakeshore Rd E, Mississauga

Nearest Intersection: Lakeshore Rd E & Dixie Rd

Pricing: TBA

Occupancy: TBA

Storeys / Suites: 2 Towers – 8 & 12 Storeys / TBA

Suite Types: One Bedroom – Three Bedroom Suites

Suite Sizes: TBA

Maintenance Fees: TBA

Deposit Structure: TBA

Incentives*: Platinum VIP Pricing & Floor Plans, First Access to the Best Availability, Capped Development Levies, Assignment, Property Management & Leasing Services Available, Free Lawyer Review of Your Purchase Agreement, Free Mortgage Arrangements

2. The Vic Condos

Introducing The Vic Condos, the newest mid-rise condominiums coming soon to your town. You’ll find everything you need around here in beautiful Downtown Streetsville; with great food, shops and sights all just a few minutes away by car or bus. And when it comes time for higher education – Its right next door to the University of Toronto – Mississauga Campus!

Developer: Forest Green Homes

Address: Tannery St & Queen St S, Mississauga

Pricing: TBA

Occupancy: TBA

Storeys / Suites: 4 Storeys / TBA

Suite Types: One Bedroom – Three Bedroom Suites

Suite Sizes: TBA

Maintenance Fees: TBA

Deposit Structure: TBA

Incentives*: Platinum VIP Pricing & Floor Plans, First Access to the Best Availability, Capped Development Levies, Assignment, Free Leasing & Property Management Services, Free Lawyer Review of Your Purchase Agreement, Free Mortgage Arrangements

Suite Finishes: Laminate Flooring, Stone Kitchen Countertops, Stainless Steel Kitchen Appliances and more

Building Amenities: TBA

3. Eleven 11 Clarkson Towns

Eleven 11 Clarkson Towns new townhomes are coming to Clarkson Village in Mississauga, Ontario. These homes will be right next door to the shops and restaurants of Lakeshore, making it easy for residents to do everything they need without having to leave home!

Developer: Saxon Developments

Address: 1111 Clarkson Rd N, Mississauga

Nearest Intersection: Clarkson Rd N & Lakeshore Rd W

Pricing: Starting From The Mid $500s

Occupancy: December 2020

Suite Types: One Bedroom – Three Bedroom Suites

Suite Sizes: 690 sq ft – 1,687 sq ft

Maintenance Fees: Approx. $0.30 / sq ft

Deposit Structure: $10,000 on Signing // 5% Minus $5,000 in 30 Days // 5% in 180 Days // 5% in 300 Days // 5% on Occupancy

Incentives: Platinum VIP Pricing & Floor Plans, First Access to the Best Availability, Capped Development Levies ($5,000 for 1 Bed // $7,500 for 2 Bed // $10,000 for 3 Bed), Free Assignment (Value of $10,000), Property Management & Leasing Services Available, Free Lawyer Review of Your Purchase Agreement, Free Mortgage Arrangements

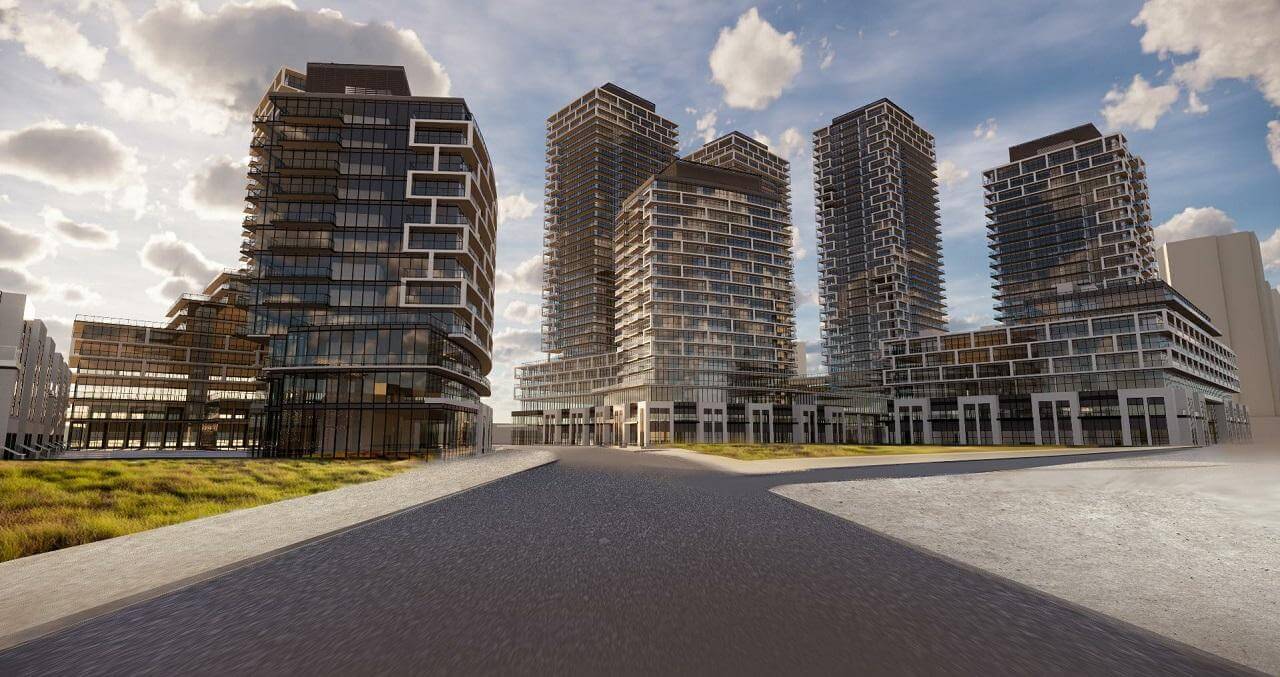

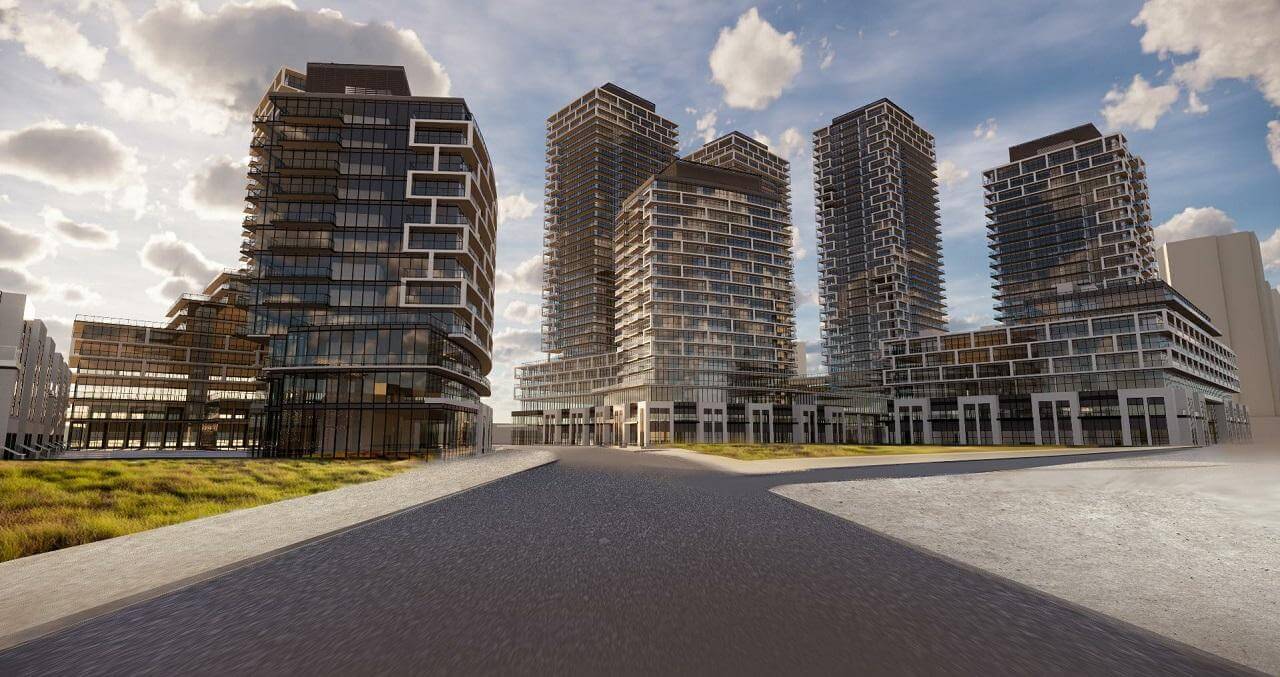

4. 91 Eglinton Ave East Condos

Introducing a new condo community in the heart of Mississauga- at 91 Eglinton Ave East! Nestled between Hurontario St. and Eglinton Ave., you will never want to leave this condominium townhome block which features 6 towers and 2 buildings all within walking distance from everything that Mississauga has to offer. From major highways, shops and schools- it’s all right around the corner for you at 91 Eglinton Ave East.

Developer: Liberty Developments

Address: 91 Eglinton Avenue East, Mississauga

Nearest Intersection: Eglinton Ave E & Hurontario St

Pricing: Anticipated To Start From The High $400’s

Occupancy: Anticipated For 2024

Storeys / Suites: Six Towers – 13, 19, 24, 25, 35, & 37 Storeys / Suites TBA

Suite Types: One Bedroom – Three Bedroom Suites + 3-Storey Townhomes

Suite Sizes: TBA

Deposit Structure: TBA

Incentives: Platinum VIP Pricing & Floor Plans, First Access to the Best Availability, Capped Development Levies, Assignment, Free Lawyer Review of Your Purchase Agreement, Free Mortgage Arrangements, Exclusive 1 Year Free Leasing Services & 1 Year Free Professional Property Management Services*

5. Kindred Condos

Introducing your next home- a beautiful new condo in Mississauga perfect for anyone who wants to be closer to everything. With Westwood Mall just around the corner, major highways and universities nearby, as well as being situated near other essential amenities; this is a great option for those looking for convenience.

Developer: The Daniels Corporation

Address: 2475 Eglinton Ave W, Mississauga

Nearest Intersection: Eglinton Ave W & Erin Mills Pkwy

Pricing: Starting From $485,900

Occupancy: February 2025

Storeys/Suites: 25-Storeys / TBA

Suite Types: Studio – Two Bedroom + Den Suites

Suite Sizes: 433 sq ft – 953 sq ft

Maintenance Fees: $0.59/sq ft (Includes Bell Gigabit Fibe 1.5 Internet // Water & Hydro Separately Metered)

Deposit Structure: $7,000 on Signing // 5% Minus $7,000 in 30 Days // 1% in 90 Days // 1% in 120 Days // 1% in 150 Days // 1% in 180 Days // 1% in 210 Days // 5% in 400 Days // 5% on Occupancy

Incentives*: VIP Pricing & First Access to the Best Availability, Capped Development Levies, Free Assignment, Free Lawyer Review of Your Purchase Agreement, Free Mortgage Arrangements, One Parking Unit ($55,000 Value) + One Locker Unit ($3,000 Value for a half-height locker or $5,000 Value for a full-height locker) Available for ONLY $45,800!*, Capped Closing Costs (All One Bedroom + Den & Smaller – $10,000 + HST // All Two Bedroom & Larger – $12,500 + HST)

Suite Finishes: Laminate Flooring, Stone Kitchen Countertops, Stainless Steel Kitchen Appliances, Stacked Washer & Dryer

Building Amenities: 24/7 Concierge, Private Roundabout Driveway Entrance, Pet Wash, Co-Working Space, Bookable Boardroom, State-of-the-Art Fitness Centre, Yoga Studio, Party Room, Outdoor Playground with Firepit, Games Room, Outdoor Terrace, Gardening Plots