Do you feel like buying a house in Canada has become an unreachable dream? With real estate prices continuing to skyrocket, it’s easy to feel overwhelmed and disheartened when considering entering the housing market. The good news is that Canada’s government can take measures to tackle the rising cost of real estate, leading to more affordable options for home buyers across the country. In this blog post we will explore what exactly the government can do to reduce costs in Canada’s current housing market and make homeownership a viable option for more Canadians. So if you’ve been dreaming about buying your first home but don’t know where or how to start, then keep reading!

The affordability crisis in Canada’s housing market

The affordability crisis in Canada’s housing market has been a topic of concern for many. With rising home prices and stagnant wages, many individuals and families find it challenging to own a home. The dream of homeownership is slowly becoming out of reach for the average Canadian. However, this is not just an individual concern, but a nationwide crisis. The increasing cost of homes is not only making it difficult for those looking to purchase a home but is also limiting the economic growth and development of the country. The government needs to take a stand and implement measures to tackle this crisis to ensure all Canadians have access to affordable housing, as it is the right of every citizen to have a safe and secure place to call home.

Suggestions for increasing the supply of affordable housing units

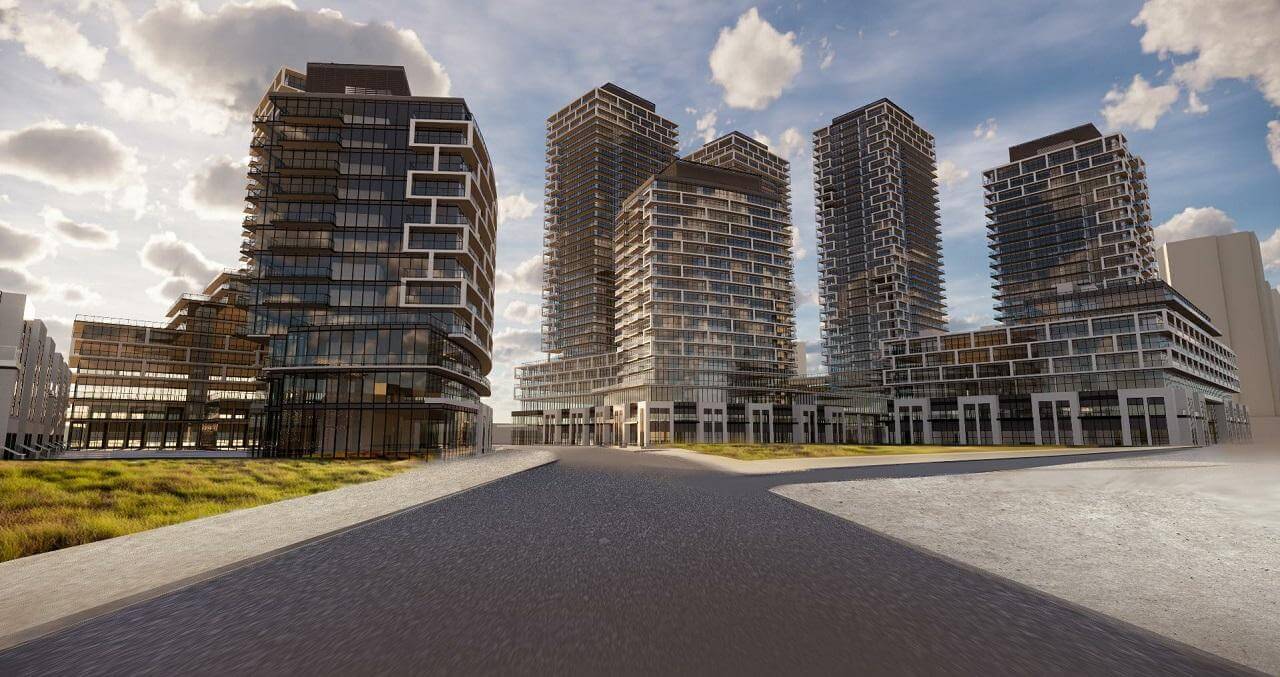

As housing prices continue to skyrocket, it’s becoming increasingly difficult for many people to find affordable places to call home. In order to combat this growing issue, we must take action. One solution is to increase the supply of affordable housing units. Whether it’s through the construction of new buildings or the creation of programs to incentivize landlords to offer affordable rents, we need to prioritize this issue. Affordable housing is not a luxury, it’s a necessity. It’s time for us to come together and find creative solutions to ensure that everyone has access to a safe and affordable place to live.

- Invest in public housing projects and initiatives

Investing in public housing projects and initiatives is not only a morally sound decision but also a smart financial move. Providing safe and affordable housing to the most vulnerable in our society is crucial for social cohesion and economic growth. Moreover, public housing investments can have a ripple effect on local economies, creating jobs and boosting local businesses. By investing in public housing, we can ensure a better future for all, while also promoting economic stability and growth. Therefore, it is imperative that we prioritize public housing initiatives and take the necessary steps to make them a reality.

- Increase the development of rental units

Rental properties are essential for individuals and families who are searching for a comfortable place to call home. The demand for rental units has never been higher, and it’s time for real estate developers to take notice. Increasing the development of rental units is not only essential for housing security but also for economic growth. By constructing more rental properties, we are not only providing individuals with an affordable and comfortable place to live, but we are also creating job opportunities and generating revenue for local businesses. Therefore, it is crucial for real estate developers to focus their efforts on expanding the availability of rental units to meet the rising demand.

- Provide incentives for builders to create more affordable units

It’s no secret that the cost of housing is skyrocketing and causing considerable financial stress for many families. The local government can address this issue by providing incentives for builders to create more affordable units. With the right incentives, builders can be encouraged to take on affordable projects that will provide much-needed housing for low and middle-income individuals. The creation of affordable housing units is not only beneficial for the residents, but it can also increase economic growth in the area. By offering incentives such as tax breaks and subsidies, the local government can help to alleviate the housing crisis while promoting a robust economy. It’s time for action, and these incentives can be the first step toward creating a brighter and more affordable future for all.

Suggestions for improving demand for affordable housing units

It is no secret that affordable housing is in high demand but low supply. As a result, it is crucial to come up with innovative ways to increase the availability of affordable housing units. By endorsing government-backed policies and partnerships between public and private entities, we can make a significant impact on this issue. Additionally, community involvement can play a crucial role in improving demand for affordable housing. Advocacy groups, neighborhood associations, and grassroots organizations can help to educate and inform residents about the importance of affordable housing and its many benefits. By taking a collaborative approach, we can work towards a future where affordable housing is not a privilege but a right for all.

- Offer tax benefits to lower-income households

Offering tax benefits to lower-income households is not just a compassionate act, but a smart economic move. By providing relief to those who need it most, we can help stimulate local economies and promote social equality. It’s no secret that people who struggle financially often have to make tough choices between basic needs like food, shelter, and healthcare. By reducing their tax burden, we can help these families make ends meet and free up resources to spend on necessities. Furthermore, boosting the purchasing power of lower-income consumers can help local businesses flourish, contributing to both economic growth and job creation. So, let’s not hesitate to offer tax benefits to those who are truly in need. It’s a powerful way to build a stronger, more equal society for all.

- Create rent assistance programs for low-income individuals and families

It is abundantly clear that low-income families and individuals often struggle to make ends meet, particularly when it comes to housing expenses. Many are forced to choose between putting food on the table and paying for a roof over their heads. As a society, we have a responsibility to assist those in need and ensure that everyone has access to safe and affordable housing. That’s why creating rent assistance programs for low-income individuals and families is not only the right thing to do, it’s also the smart thing to do. By providing targeted support to those who need it most, we can help lift families out of poverty and create a more equitable society for all. Let’s make sure that no one has to choose between shelter and sustenance, and instead provide the support necessary for all individuals and families to thrive.