Navigating the decision to sell a family home can be overwhelming. Whether you’re downsizing, relocating, or managing an estate after a loved one’s passing, an estate sale can provide a strategic way to liquidate assets efficiently. Understanding the real estate market trends over the past six months can help you make informed decisions and maximize your profit. In this blog, we’ll delve into recent estate sale statistics for the Greater Toronto Area (GTA) and provide expert advice on conducting a successful estate sale.

Understanding Estate Sales

What is an Estate Sale?

An estate sale involves selling most or all of an individual’s possessions, typically after significant life events such as a move, divorce, or death. These sales are often managed by professional estate sale companies that specialize in appraising, organizing, and selling items ranging from everyday household goods to high-value collectibles.

Benefits of an Estate Sale

- Financial Efficiency: Generate significant revenue by selling valuable items that might otherwise go unused.

- Simplification: Reduce the burden of managing a large number of items during a life transition.

- Equitable Distribution: Ensure fair distribution of assets among heirs in the case of estate settlements.

Market Trends: A Six-Month Review

Understanding recent market trends is crucial for timing your estate sale to maximize profit. Here’s an overview of the estate sale market in the GTA over the past six months, focusing on key statistics and changes.

Estate Sales in Toronto:

- January 2024:

- Total estate sales: 38

- Average value per sale: $23,000

- February 2024:

- Total estate sales: 40

- Average value per sale: $22,500

- March 2024:

- Total estate sales: 42

- Average value per sale: $24,000

- April 2024:

- Total estate sales: 43

- Average value per sale: $23,500

- May 2024:

- Total estate sales: 44

- Average value per sale: $24,500

- June 2024:

- Total estate sales: 45

- Average value per sale: $25,000

Estate Sales in Ontario:

- January 2024:

- Total estate sales: 200

- Average value per sale: $18,000

- February 2024:

- Total estate sales: 205

- Average value per sale: $18,500

- March 2024:

- Total estate sales: 210

- Average value per sale: $19,000

- April 2024:

- Total estate sales: 215

- Average value per sale: $19,500

- May 2024:

- Total estate sales: 218

- Average value per sale: $20,000

- June 2024:

- Total estate sales: 220

- Average value per sale: $20,000

Key Trends and Insights

- 1. Increasing Popularity

- The steady increase in the number of estate sales from January to June indicates growing popularity as a means of asset liquidation.

- Rising Average Value

- Both Toronto and Ontario have seen a gradual rise in the average value of items sold per sale, suggesting strong demand for high-quality estate sale items.

- Seasonal Variations

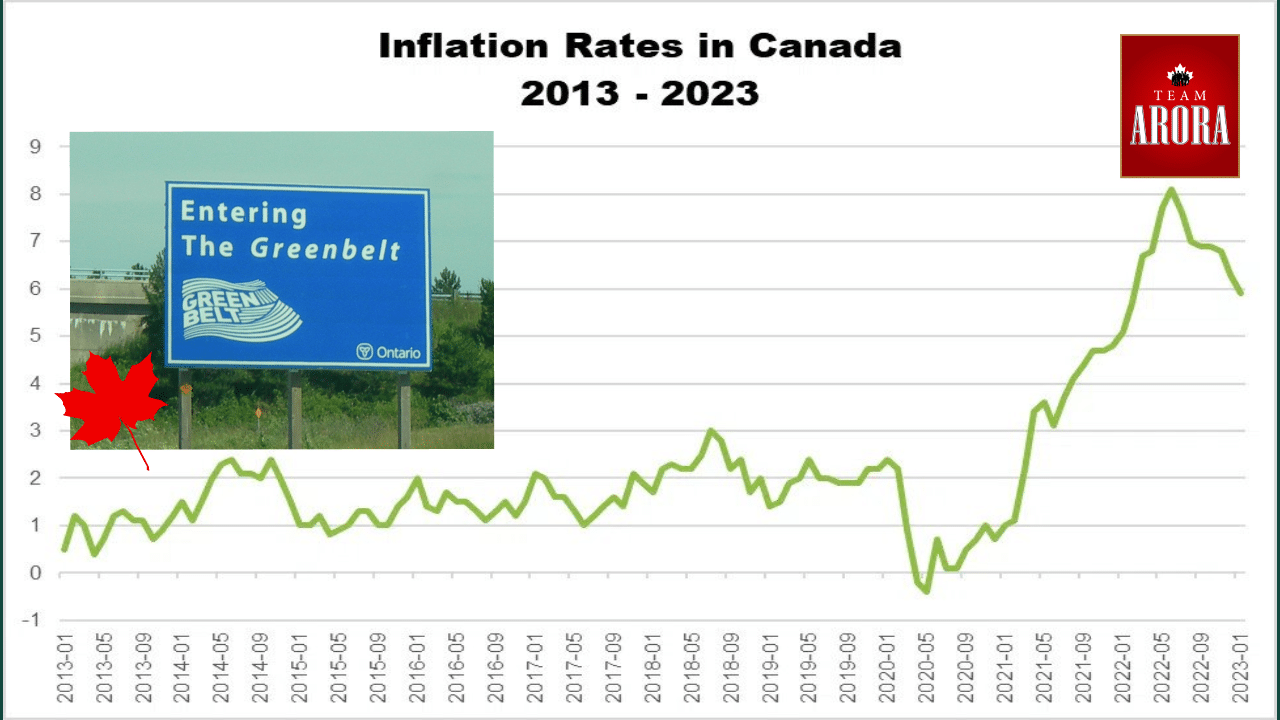

- The data shows a slight dip in sales during the colder months (January and February), with a steady increase as the weather improves, indicating a seasonal influence on estate sales.

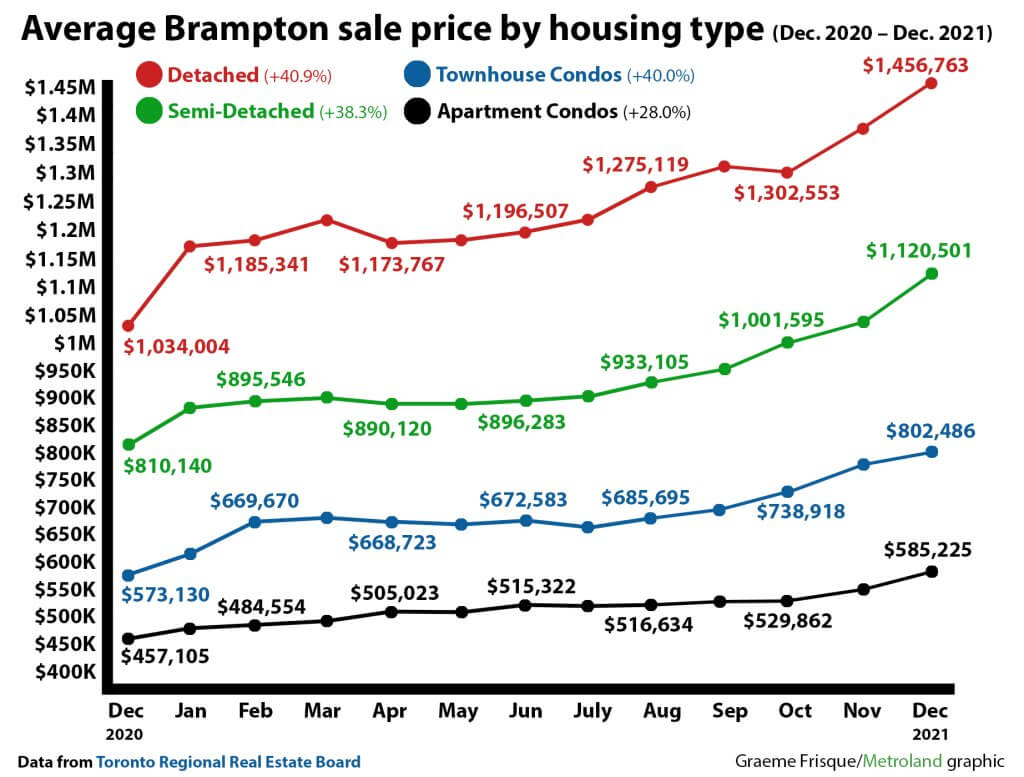

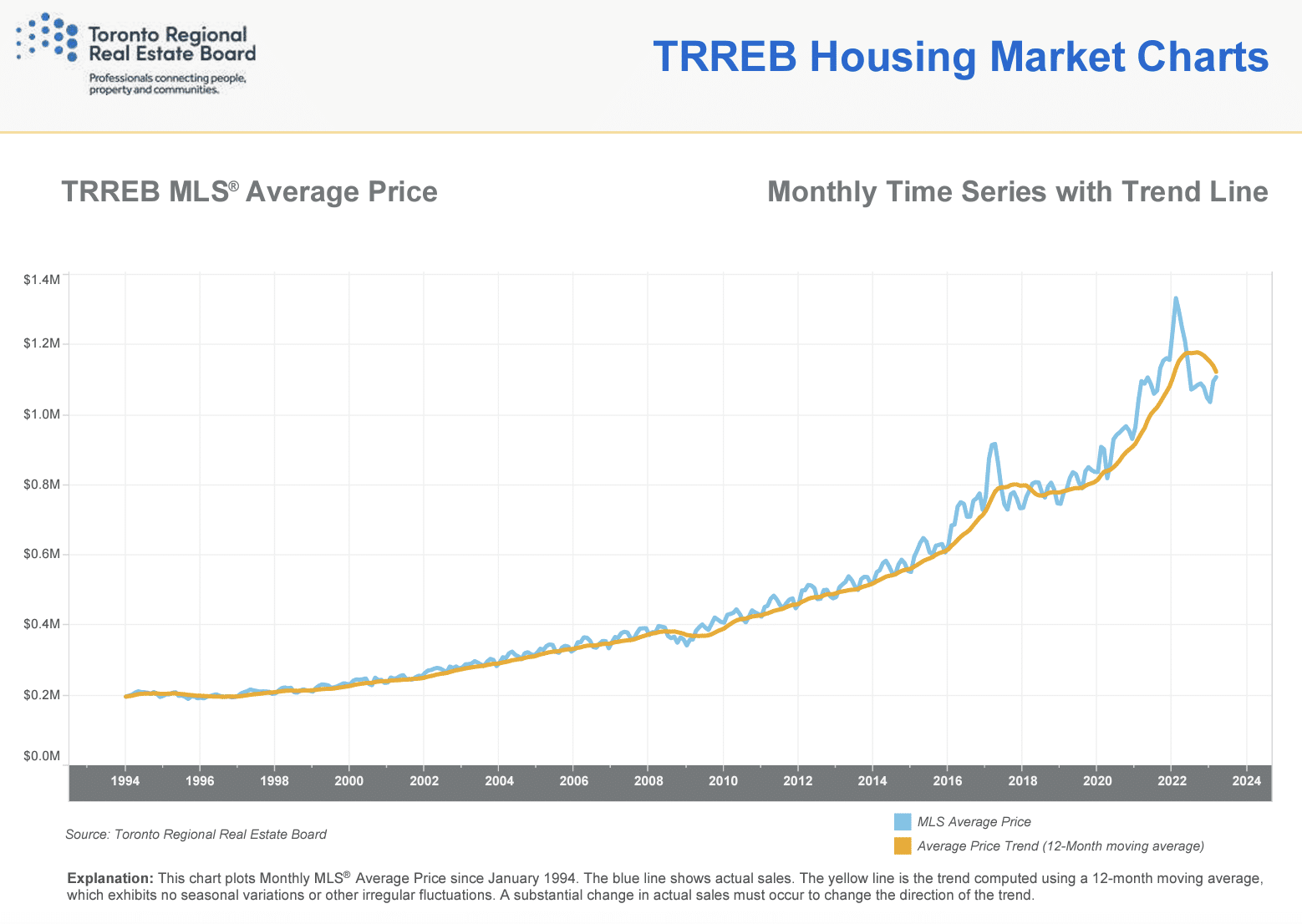

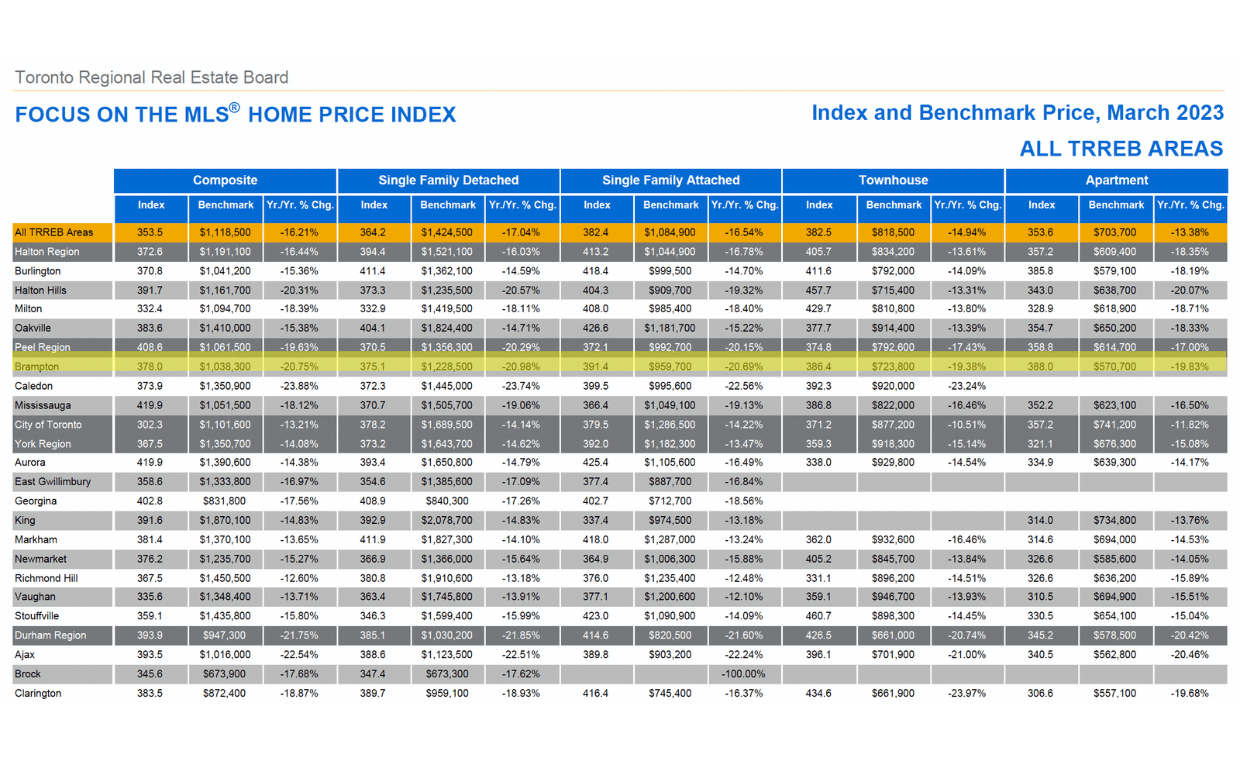

GTA Housing Market Overview (May 2024)

- Detached Homes: $1,506,675 (3% decrease from May 2023)

- Semi-Detached Homes: $1,173,819 (2% decrease from May 2023)

- Freehold Townhouses: $1,040,141 (7% decrease from May 2023)

- Condo Apartments: $730,815 (2.4% decrease from May 2023)

This statistical overview helps set the context for the real estate market’s condition, which directly impacts estate sales.

Preparing for an Estate Sale

Hiring Professionals

One of the first steps in preparing for an estate sale is hiring a professional estate sale company. These experts can handle everything from appraising and pricing items to organizing and marketing the sale, ensuring a smooth process and fair market value for items sold.

Organizing and Appraising

Professional organizers will:

- Inventory Items: Create a comprehensive list of items to be sold.

- Appraise Items: Determine the value of each item, ensuring high-value items are priced appropriately.

- Set Up the Sale: Organize items appealingly to attract buyers.

Marketing the Sale

Effective marketing is crucial for a successful estate sale. Professional estate sale companies will:

- Advertise Locally and Online: Use various platforms to reach potential buyers, including social media, estate sale websites, and local classifieds.

- Highlight High-Value Items: Emphasize unique and valuable items to attract serious buyers and collectors.

Conducting the Sale

Managing the Event

During the sale, professionals manage all aspects of the event, including:

- Customer Service: Assisting buyers with questions and facilitating transactions.

- Security: Ensuring the safety of items and managing crowd control.

- Negotiations: Handling price negotiations to maximize returns.

Post-Sale Activities

After the sale, the estate sale company will:

- Clear Out Remaining Items: Arrange for the donation or disposal of unsold items.

- Final Settlement: Provide a detailed account of the sale and disburse proceeds to the family or estate.

An estate sale is a practical and efficient way to liquidate assets, whether due to relocation, downsizing, or settling an estate. By understanding the nuances of estate sales and staying informed about market trends in Toronto and Ontario, families can make informed decisions to maximize the benefits of their sales. Engaging professional estate sale services ensures a smooth process and optimal results, providing peace of mind during a challenging time.

Recommendations

For those considering an estate sale, here are a few tips:

- Start Early: Give yourself time to organize and prepare for the sale.

- Hire Professionals: Engage experienced estate sale companies to handle the details.

- Stay Informed: Keep abreast of market trends to time your sale for the best results.

By following these steps, you can confidently navigate the complexities of an estate sale and ensure you achieve the best possible outcome for your family’s assets.

Citations

- “Data sourced from the Greater Toronto Area (GTA) Housing Market Overview, May 2024, provided by Wahi: [link to source]

Monthly estate sale statistics in Toronto and Ontario: Realtor.ca, Wowa.ca, Stashestates.com, Zolo.ca, TRREB.ca, and other market analysis websites.”