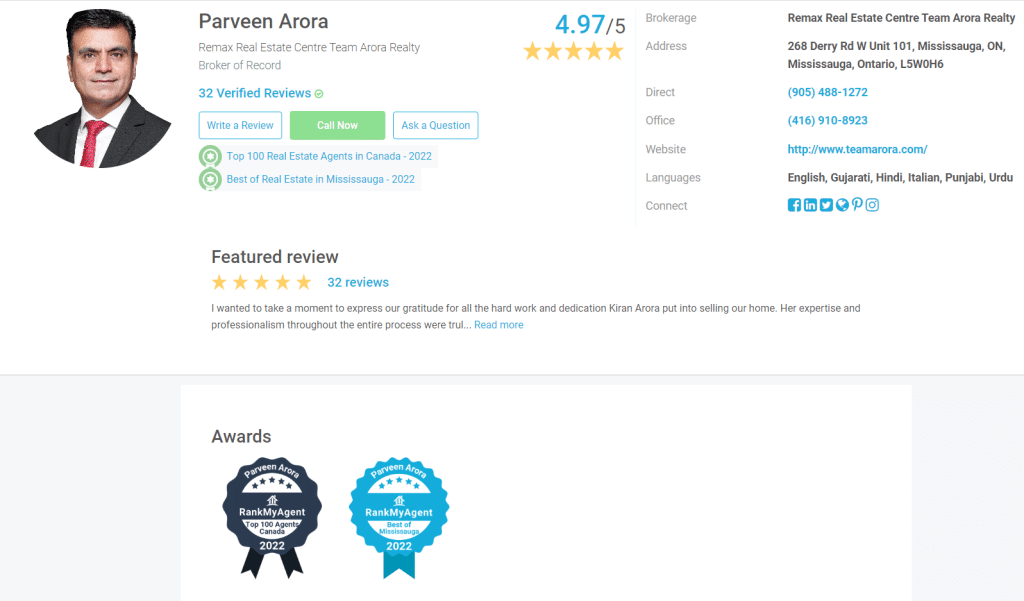

Are you thinking about selling your home in Kitchener, Waterloo, or Cambridge (KWC)? If so, you’re likely searching for a reliable real estate partner who can help you navigate the process with ease and expertise. At Team Arora, we understand that selling your home is a significant decision, and we’re here to make the experience as smooth and successful as possible. With over 20 years of experience in the real estate industry, our team of expert agents specializes in home evaluations and pre-construction projects, ensuring you get the best value for your property. Here’s why you should trust Team Arora to sell your home in KWC.

What Sets Team Arora Apart?

Selling a home requires strategic planning, market knowledge, and effective negotiation skills. At Team Arora, we bring all these elements together to provide a comprehensive service tailored to your needs. Here’s what makes us stand out:

- Extensive Experience: With over two decades in the real estate business, we have a deep understanding of the market dynamics in KWC. Our experience translates into insightful advice and effective strategies that help you sell your home quickly and at the best price.

- Specialized Agents: Our team includes expert agents who specialize in different aspects of real estate. Whether you need a precise home evaluation or want to explore pre-construction projects, we have the right professionals to assist you. This specialized approach ensures that every aspect of your property sale is handled with the utmost care and expertise.

- Local Market Knowledge: Being based in KWC, we have a thorough understanding of the local market trends, property values, and buyer preferences. This local expertise allows us to position your home effectively in the market and attract the right buyers.

- Personalized Service: We believe in providing personalized service that caters to your unique needs. From the initial consultation to the final sale, we work closely with you to understand your goals and tailor our approach accordingly.

- Comprehensive Marketing: To ensure your home gets the attention it deserves, we utilize a blend of traditional and digital marketing strategies. This includes professional photography, virtual tours, social media promotions, and listings on popular real estate platforms. Our goal is to maximize your home’s visibility and attract a wide pool of potential buyers.

How Does Team Arora Help in Home Evaluations?

Accurate home evaluation is a critical step in the selling process. It sets the foundation for pricing your property correctly and attracting serious buyers. At Team Arora, our home evaluation process is thorough and precise:

- Market Analysis: We start with a comprehensive market analysis, comparing your home to similar properties recently sold in your area. This helps us understand the current market conditions and set a competitive price.

- Property Inspection: Our expert agents conduct a detailed inspection of your property, assessing its condition, features, and any unique selling points. This on-site evaluation allows us to highlight your home’s strengths and address any potential issues.

- Customized Report: Based on our analysis and inspection, we provide you with a detailed home evaluation report. This report includes a suggested listing price, market trends, and recommendations for enhancing your property’s appeal.

What About Pre-Construction Projects?

Pre-construction projects can be an attractive option for buyers looking for modern amenities and custom features. If you’re considering selling a pre-construction property, Team Arora can help:

- Project Promotion: We showcase pre-construction projects through targeted marketing campaigns, highlighting the benefits of buying new. This includes promoting the latest developments, floor plans, and customization options available to buyers.

- Buyer Education: Our agents educate potential buyers about the advantages of purchasing pre-construction properties, such as modern designs, energy efficiency, and the opportunity to personalize their new homes.

- Smooth Transactions: We facilitate smooth transactions by coordinating with developers, handling paperwork, and ensuring all legal requirements are met. This hassle-free process makes it easier for buyers to commit to a pre-construction purchase.

Comprehensive Services for All Property Types

At Team Arora, we pride ourselves on handling all types of properties. Whether you’re selling a family home, a retail space, or a piece of land, our team has the expertise to manage the sale efficiently. Here’s how we approach different property types:

- Residential Properties: From cozy starter homes to luxurious estates, we provide tailored marketing strategies to showcase your property’s best features and attract the right buyers.

- Commercial Properties: Selling commercial real estate requires a deep understanding of market dynamics and business needs. Our agents are skilled in highlighting the investment potential and strategic advantages of commercial properties.

- Land Sales: Land sales involve unique challenges and opportunities. We assess the land’s potential for development, zoning regulations, and market demand to position it effectively in the market.

Real-Time Market Updates and Trends

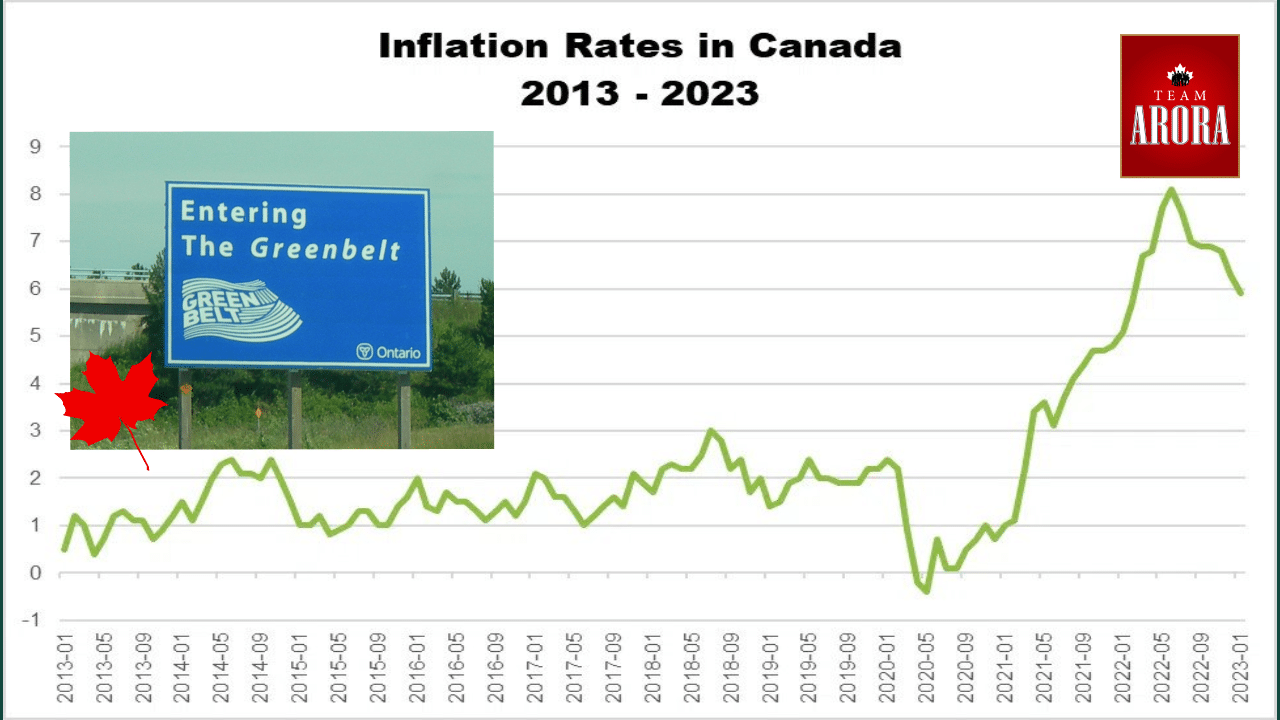

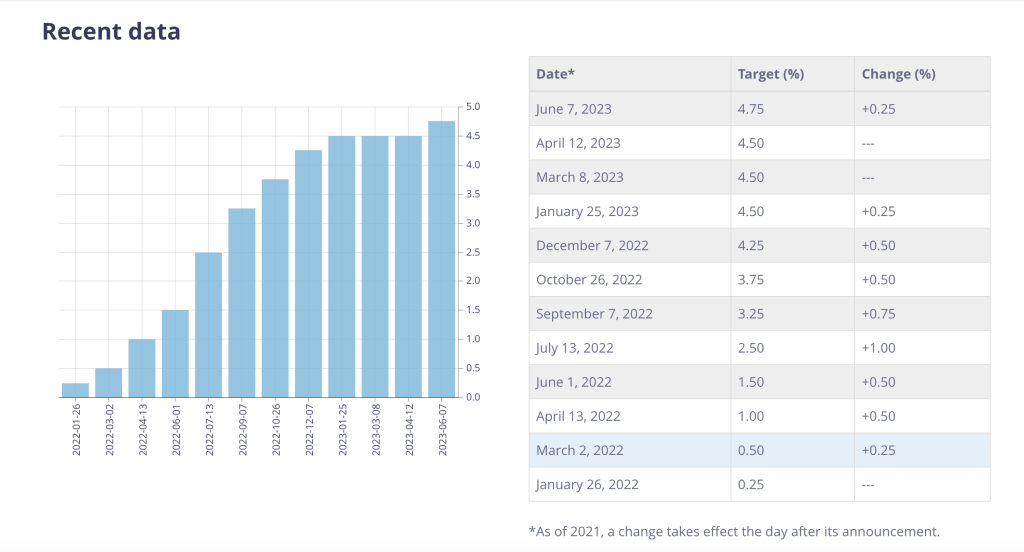

Staying up-to-date with the latest real estate market trends is crucial for making informed decisions. The KWC real estate market has seen some interesting trends recently:

- Increasing Demand: The demand for residential properties in KWC continues to grow, driven by the region’s economic development and high quality of life. Buyers are particularly interested in homes with modern amenities and energy-efficient features.

- Rising Property Values: Property values in KWC have been steadily increasing, making it a great time to sell. Our expert agents keep a close eye on market fluctuations to ensure you get the best possible price for your property.

- Shift Toward Suburban Living: With more people working from home, there’s a noticeable shift toward suburban living. Buyers are looking for spacious homes with outdoor areas, making KWC’s real estate market more attractive than ever.

- Sustainable and Smart Homes: There’s a growing interest in sustainable and smart home technologies. Properties equipped with energy-efficient systems and smart home features are in high demand, appealing to eco-conscious buyers.

Success Stories and Testimonials

At Team Arora, our greatest satisfaction comes from helping our clients achieve their real estate goals. Over the years, we’ve built a strong reputation in KWC for our professionalism, dedication, and results-driven approach. Here are a few success stories from our satisfied clients:

- John and Sarah: “Selling our home with Team Arora was a seamless experience. Their expertise in home evaluation and marketing helped us get a great price quickly. We highly recommend their services!”

- Emily: “As a first-time seller, I was nervous about the process. But Team Arora’s personalized service and constant support made everything easy and stress-free. I’m grateful for their help in selling my home.”

- Michael: “The team’s knowledge of the local market was evident from the start. Their strategic approach and excellent negotiation skills ensured we got the best deal. We couldn’t be happier with the outcome!”

Frequently Asked Questions (FAQs)

- How long does it take to sell a home in KWC? The time to sell a home in KWC can vary, but with Team Arora’s expertise, most homes sell within a few weeks to a couple of months, depending on market conditions.

- What factors influence the value of my home? Factors include location, condition, size, and recent comparable sales in your area. Our expert agents will provide a detailed evaluation to determine your home’s market value.

- What are the benefits of selling a pre-construction property? Pre-construction properties often attract buyers looking for modern amenities and customization options. They can also sell at a premium due to their newness and potential for future value appreciation.

- How do I get started with Team Arora? Simply contact us through our website or at 416.910.8923. We’ll schedule a consultation to discuss your goals and create a tailored plan to sell your property.

Contact Us Today!

Ready to sell your home or property in Kitchener, Waterloo, or Cambridge? Let Team Arora guide you through the process with our expertise and personalized service. Contact us today to schedule a consultation and take the first step towards a successful sale. Visit our website at www.teamarora.com or call us at 416.910.8923.

We look forward to helping you achieve your real estate goals!