In the world of real estate, finding the right property dealer can make all the difference in ensuring a smooth and successful transaction. When it comes to buying or selling a home, condos, pre-construction properties, or land, Team Arora is a name you can trust. With a proven track record of excellence and a commitment to providing exceptional service, Team Arora has earned its place as one of the best real estate property dealers in Canada. In this blog, we will explore why Team Arora stands out from the rest and how they can help you achieve your real estate goals.

Unparalleled Expertise

As experienced real estate agents, the team at Team Arora possesses extensive knowledge of the Canadian real estate market. Whether you are a buyer or a seller, they understand the intricacies of the industry and can guide you through the entire process. Their expertise covers a wide range of property types, including residential homes, condos, pre-construction properties, and land sales.

Accolades and Recognition

Team Arora’s commitment to excellence has not gone unnoticed. In 2018, we were awarded the prestigious title of #1 Remax Team in Canada, a testament to their outstanding performance and exceptional service. These accolades serve as a testament to their dedication to their clients and their ability to deliver results.

Getting the Best Prices

When it comes to selling your property, Team Arora is known for their skill in negotiating the best and higher prices. They understand the local market trends, assess the value of your property accurately, and utilize their extensive network to attract potential buyers. Their expertise and experience allow them to maximize the selling price of your property, ensuring you get the most out of your investment.

Finding the Right Property

On the other hand, if you’re in the market to buy a home, condos, pre-construction properties, or land, Team Arora is there to help you find the perfect match. They take the time to understand your needs, preferences, and budget to identify properties that align with your requirements. With their extensive network and access to a wide range of listings, they can provide you with a diverse selection of options to choose from.

Exceptional Customer Service

One of the key factors that set Team Arora apart is their dedication to providing exceptional customer service. They understand that buying or selling a property can be a complex and emotional process, and they strive to make it as seamless as possible for their clients. Their team of professionals is always available to answer your questions, address your concerns, and provide guidance throughout the entire real estate journey.

When it comes to buying or selling real estate in Canada, Team Arora is the name to trust. Their proven track record, industry expertise, and commitment to exceptional service make them the best real estate property dealers in Canada, but in some cities like GTA, Mississauga and Kitchener are our priorities. Whether you’re looking to sell your property at the best price or find your dream home, condos, pre-construction property, or land, Team Arora has the knowledge and experience to guide you every step of the way. Contact Team Arora today and experience the difference of working with a top-tier real estate team.

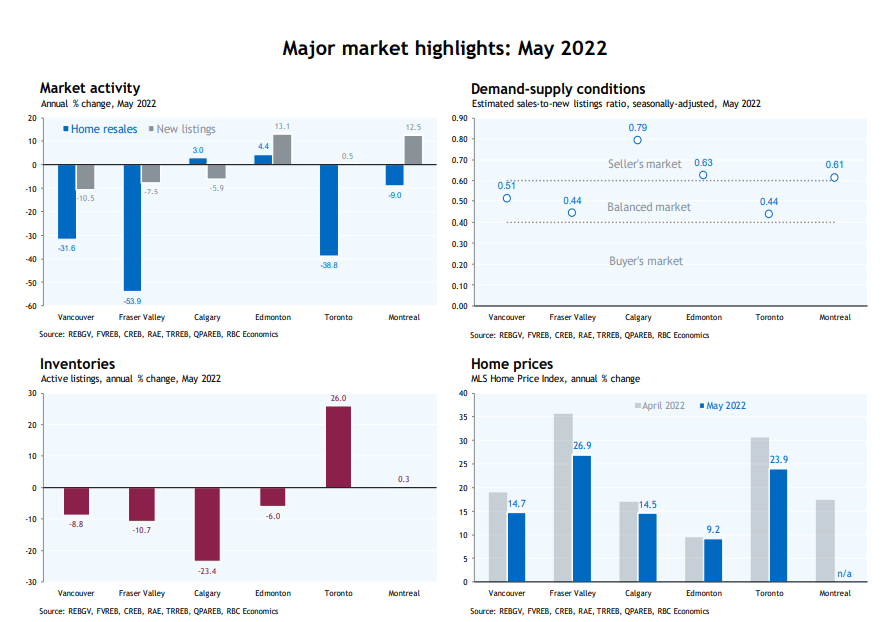

Source: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics | *Yellow dot indicates estimate for May 2022

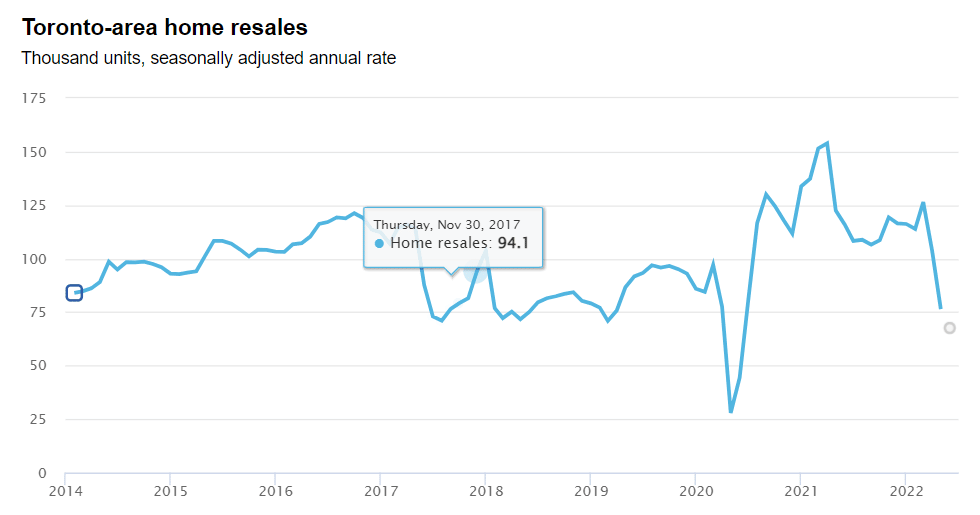

Source: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics | *Yellow dot indicates estimate for May 2022