Since August is typically a slower month in the resale market because of summer vacations, and given that buyers are unsure about their purchasing power due to potential interest rate hikes, existing homeowners who will soon need to renew their mortgage may face even higher costs.

While Sales and Listing Activity Fell, Ontario Sees More Quiet Summer Season.

Toronto,01 September 2022 – The Toronto Regional Real Estate Board (TRREB) MLS® System reported 5,627 home sales in August 2022. This number is a 34.2% decrease from the previous year but shows improvement compared to the last few months; there was even a month-over-month increase from July.

The housing market was mainly influenced by supply and demand. Inventory rose for the third consecutive month, representing a larger portion of new listings than in the previous three months. If this pattern persists, it might indicate an interest in selling prices in the months ahead. The MLS® Home Price Index (HPI) increased by 8.9% on an annual basis, while the average selling price for all types of homes combined grew by 0%.

Compared to July, the average selling price in August was slightly higher, while the HPI Composite was lower. This suggests that a greater share of more expensive home types were sold in August.

The recent increase in mortgage borrowing costs has dampened the desire of many homebuyers to purchase. However, existing homeowners near their mortgage renewal period are also facing higher fees. There is space for the federal government to help more people buy homes by eliminating the stress test when borrowers switch lenders, which would allow for greater competition in the housing market.

Furthermore, allowing for longer amortization periods on mortgage renewals would benefit current homeowners in an inflationary environment, according to TRREB President Kevin Crigger.

The Office of the Superintendent of Financial Institutions (OSFI) should give their opinion on whether or not the current stress test is still useful. Should home buyers be tested at a rate two percent higher than the already high rates, or would it make more sense to have a test that adapts based on interest rates?

TRREB CEO John DiMichele said that OSFI should also remove the stress test for people who currently have mortgages and want to shop around for a better rate at renewal. This is especially an issue when they’re not asking for any extra funds, he said.

Aside from borrowing costs, there are other factors that have an impact on housing affordability in the Greater Golden Horseshoe. Longer-term, the capacity to produce more is the challenge. However, we are making progress in this area. The province’s strong mayor idea, as well as Mayor John Tory’s recent commitment to increase home ownership and rental housing choices, are good examples of this. TRREB is hopeful to hear more ideas from the candidates running for office in the upcoming municipal elections, said TRREB Chief Market Analyst Jason Mercer.

Brampton’s Housing Market in 2022

August Resale Sales Are Slowing Down Because of Buyer Uncertainty

Members of the Ottawa Real Estate Board sold 1,137 homes through the Board’s Multiple Listing Service® System in August, compared to 1,565 houses a year ago, a decrease of 27%. In August, 850 residential properties were sold, down 27% from last year and 287 condominium properties were sold this month. The five-year mean for total unit sales in August is 1,603.

“In the resale market in Ottawa, August is usually a less active month as a result of summer vacations. Given impending further interest rate increases, Buyers are worried about their purchasing power.

“The lightning speed at which homes were selling at the start of 2022 is a thing of the past, evidenced by Days on Market (DOMs) inching closer to that 30-day mark. We have also observed a return to standard financing and inspection conditions and fewer multiple offer scenarios,” she adds.

The average sale price for a condo-class residence in August was $421,966, up 4% from 2021.

The median sale price for a residential-class property was $707,712, up 5% from last year.

The average sale prices for residential properties and condominiums are currently $795,978 and $457,771 respectively. These values illustrate a 10% and 9 percent increase from last year.*

In August, 2,093 properties were listed which has increased inventory to nearly 3 months for residential class properties and 2.2 months for condominiums.

“Prices in some areas are still rising, albeit at lower single-digit percentages. This is bringing back the moderate price growth stability that is characteristic of the Ottawa resale market,” says Toronto real estate agent Steve Torontow. “What happened to prices in 2020 and 2021 was unusual. We are moving towards a balanced market state, where Buyers have choices and Sellers need to ensure they are pricing their properties accurately.”

“A licensed REALTOR®’s market knowledge and insight are crucial to both buyers and sellers, especially in today’s changing housing market. Sellers will want to consult their REALTOR® on the best time and price to put their property on the market while also optimizing its days on market. Buyers may use the extra time to collaborate with their Realtor® on diligence, as well as finding a dream house that meets their needs within their financial constraints.”

In addition to helping find rentals, REALTORS® also screen potential tenants. OREB Members have assisted clients with renting 4,172 properties since the beginning of this year–a 29% increase over last year’s numbers.

In the second quarter of this year, there were fewer home buyers and sellers in the British Columbia housing market than there were in July.

Metro Vancouver’s housing market is experiencing a more subdued summer season, with reduced sale and listing activity.

In August 2022, the Real Estate Board of Greater Vancouver (REBGV) stated that residential property sales in the region totaled 1,870 in August, a 40.7% decrease from the 3,152 sales noted in August 2021 and a 0.9% decrease from the 1,887 properties sold in July 2022.

“With inflationary pressure and interest rates on the rise, home buyer and seller activity fell below our long-term seasonal norms this summer. Over the previous four months, prices have declined as a result of this change in market conditions. ”

In August 2022, there were 3,328 detached, attached, and apartment properties newly listed on the Multiple Listing Service® (MLS®) in Metro Vancouver. This is a 17.5% decrease compared to the 4,032 homes put up for sale in August 2021 and a 16% drop compared to July 2022 when 3,960 houses were marketed.

The MLS® system in the region of Metro Vancouver currently has 9,662 properties for sale, a 7.3% increase compared to August 2021 (9,005) and a 6.1% decrease compared to July 2022 (10,288).

“Homebuyers and sellers are spending more time thinking about the impact this changing environment will have on their housing requirements,” said Lis. “Preparation is critical in today’s climate. Assess what current home prices, financing alternatives, and other criteria mean for you with your Realtor.”

The sales-to-active listings ratio for all property types was 19.4% in August 2022. The ratio is 12.2% for detached homes, 25.3 percent for townhomes, and 24.8 percent for apartments, according to analysts . When the percentage drops below 12 over a lengthy period of time, home prices tend to be depressed; when it exceeds 20 percent over several months, home values generally rise.

The MLS Home Price Index composite benchmark price for all residential properties in Metro Vancouver is $1,180,500. This represents a 7.4% increase over August 2021 and a 2.2% decrease from July 2022.

In August 2022, the sales of detached homes reached 517; this number is 45.3% lower than the 945 detached sales recorded in August 2021. Additionally, the benchmark price for a detached home is $1,954,100; note that this figure represents a 7.9% increase from August 2021 but also a 2.3% decrease when compared to July 2022’s numbers.

In August 2022, sales of apartment residences fell to 998, a 38.8% reduction from the 1,631 sales in August 2021. The average price for an apartment home is $740,100. This indicates an 8.7% increase over August 2021 and a 0.9% reduction compared to July 2022.

In August 2022, 355 attached home sales were recorded, a 38.4% decrease from the 576 transactions in August 2021. The typical price of an attached property is $1,069,100. This represents a 12.7% increase from August 2021 and a 2.5% decline compared to July 2022 .

With fewer new listings in August, Alberta’s supply levels ease.

The City of Calgary’s month-over-month sales activity was comparable to last year’s strong levels, and significantly exceed long-term trends for the month. While sales have remained relatively robust, there has been a movement towards cheaper alternatives as the year-over-year reduction in detached sales was just about matched by increases for multi-family product types.

CREB® Chief Economist Ann-Marie Lurie stated that although higher lending rates have decreased activity in the detached market, homebuyers are still choosing more affordable options. This is keeping sales activity steady compared to other large cities where sales have drastically pulled back.” New listings continue to trend down while supply remains unchanged.

Despite year-over-year increases in new listings, the gap between new listings and sales narrowed this month compared to the previous three months. This resulted in total inventory decreasing and preventing any substantial shift in supplies. August’s months of supply remained at roughly two months, not as tight as earlier in the year but still below normal levels seen this time of year.

For the third month consecutively, benchmark prices have slowly decreased to $531,800. While this reduction indicates changing market conditions, it is crucial to remember that any progress made earlier has not vanished–prices are still over 11% better than they were last year.

The number of new home listings to purchasers in the Toronto region was down by 13 per cent year-over-year. This indicates that sellers are being more selective about who they sell to and is a sign of market conditions improving. The good news is that sales have continued to grow, albeit at a slower pace than they were earlier in the year. While the recent drops haven’t offset the strong increases reported throughout 2018, things are changing in this sector of the market. At the same time, we’ve witnessed supply increase in higher-priced homes, which is aiding healthier balance.

The higher demand from buyers has caused prices to trend downward in recent months, though with a benchmark price of $633,000, levels are still over 13% higher than last year.

Semi-Detached – There was a large decline in new listings relative to a slight decrease in sales for semi-detached properties this month. This caused the sales-to-new-listings ratio to rise above 80% for the first time since April, while total inventory decreased compared with levels seen during the previous several months and last year. Price ranges, in particular lower price ranges, continue to exhibit varied market conditions, much like the detached sector.

Although prices this month went down compared to May, they are still over 10% higher than they were last year. The benchmark price is now $569,300. (Source)

Despite sales trends indicating a decline from previous years, the row-home market is still healthy and year-to-date totals are around 50% greater than last year. At the same time, this month saw a significant drop in new listings, resulting in decreased inventory levels. This prevented any big changes to the months of supply, which remained under two months for the fourth consecutive month.

The housing market is continuing to be fairly stable, despite the fact that market conditions are still tough. Overall, the benchmark price for row houses in August was 14% higher than those recorded last year.

The appeal of the condominium market has increased with the national economy, and Apartment Condominium – Sales activity improved in August, contributing to year-to-date sales of 4,576 units, which is a 65% increase over last year. Some of this growth was aided by an increase in supply within this sector. The recent rise in volume relative to new listings has narrowed the gap in supply.

Despite the fact that circumstances have changed in recent months, rental prices continue to be relatively stable when compared to July, but they are more than 10% higher than last year’s rates. Despite the present increases in costs, apartment condominium sales remain well below peak values reached in 2014.

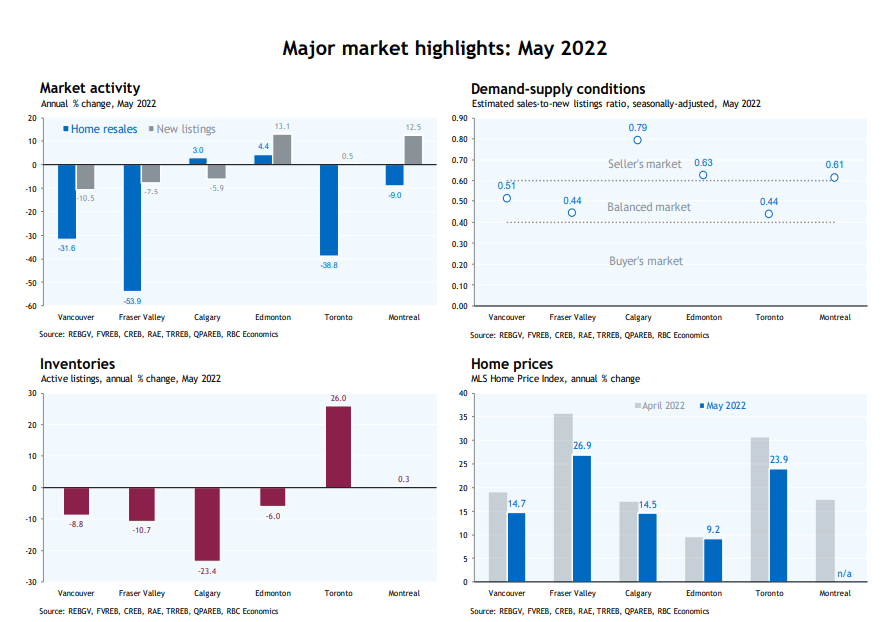

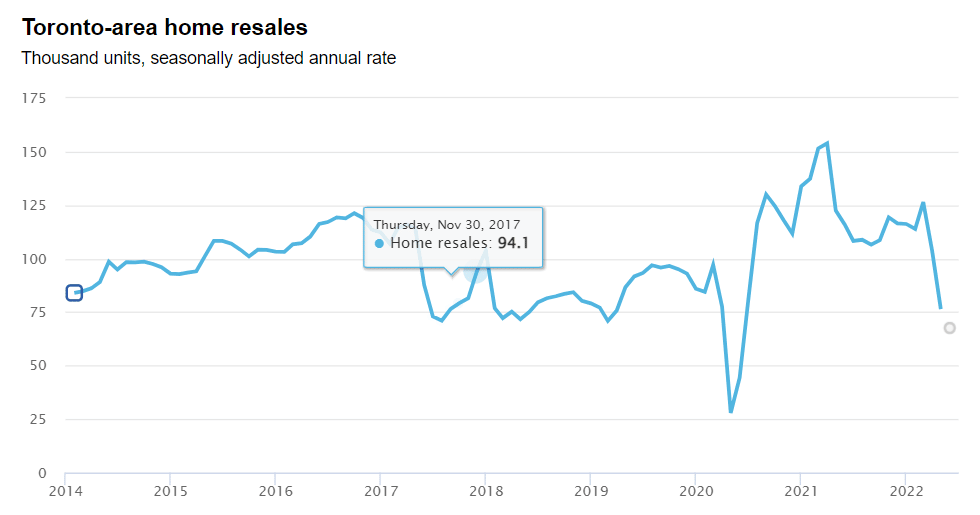

Source: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics | *Yellow dot indicates estimate for May 2022

Source: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics | *Yellow dot indicates estimate for May 2022