When searching for your dream home in the Greater Toronto Area (GTA), it is crucial to consider not only the property’s price but also the associated property tax rates. In this informative guide, we will delve into the highest and lowest property tax rates across the GTA, with a particular focus on the city of Mississauga. Let’s explore how property taxes can impact your real estate investment.

Understanding Property Taxes

“Property taxes are a crucial aspect of homeownership”, as they help fund local services such as schools, roads, and public safety. These taxes are calculated based on the assessed value of the property and are typically charged annually.

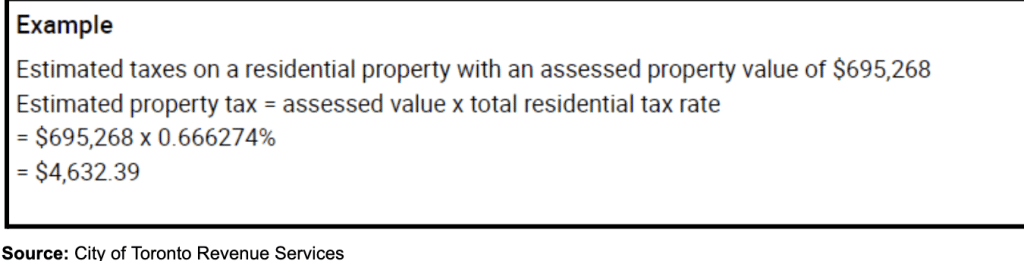

According to the official website of the City of Toronto, the property tax bill is calculated by

“by multiplying the current year phased-in property assessment value, as determined by the Municipal Property Assessment Corporation (MPAC), by Council approved City Tax Rate(s) with the City Building Fund Levy and the Education Tax Rate, as set by the Government of Ontario.”

Further, property tax rates vary across municipalities within the GTA, allowing for regional distinctions. By understanding these rates, prospective homeowners can make informed decisions about where to invest in real estate.

Highest Property Tax Rates in the GTA

When it comes to the GTA’s highest property tax rates, certain municipalities stand out. While there are variations year-to-year – based on the information available as of the time of writing this article in June 2023 – the City of Toronto had one of the highest property tax rates in the region. However, it is important to note that the exact rates are subject to change annually, depending on local government budgets and assessments. It is advisable to consult the latest information from the respective municipal tax authorities for the most accurate data.

Lowest Property Tax Rates in the GTA

If you are seeking more affordable property tax rates in the GTA, you might consider exploring other municipalities such as Mississauga. Currently, Mississauga has relatively lower property tax rates compared to Toronto. This can make a significant difference in your overall homeownership expenses, especially when combined with competitive home prices.

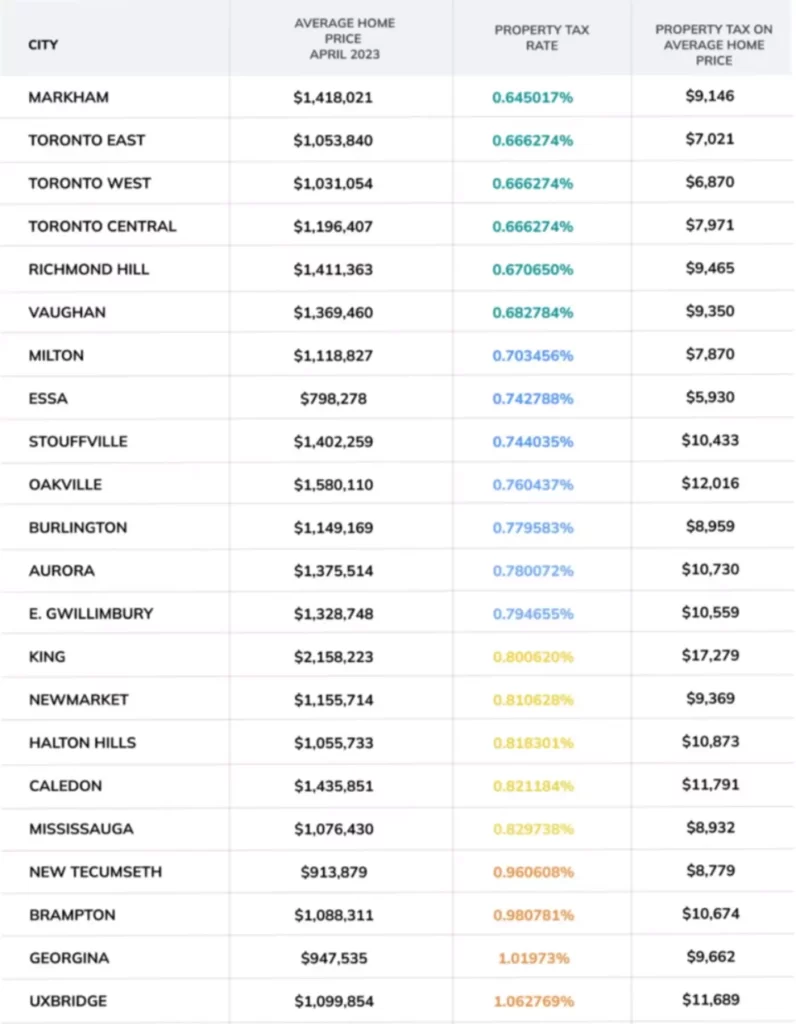

Property Taxes of Cities in the GTA 2023

Buying Homes in Mississauga: A Smart Investment

For those looking to buy a home in the GTA, Mississauga offers an enticing combination of lower property tax rates and diverse real estate options. From charming suburban neighborhoods to sleek urban condos, Mississauga provides a range of housing choices to suit various budgets and lifestyles.

Moreover, Mississauga’s strategic location adjacent to Toronto and excellent transportation infrastructure make it an ideal choice for commuters. With well-regarded schools, abundant green spaces, and a thriving cultural scene, Mississauga has become a desirable destination for families and young professionals alike.

Conclusion

When searching for your dream home in the GTA, it’s essential to consider property tax rates as a part of your decision-making process. Understanding the highest and lowest property tax rates across the region can help you make an informed choice about where to invest.

While Toronto tends to have higher property tax rates, Mississauga offers a more affordable alternative. With its lower tax rates and attractive real estate options, Mississauga homes for sale provide an excellent opportunity for buyers.

That said, remember to stay updated with the latest information on property tax rates as they can vary annually.