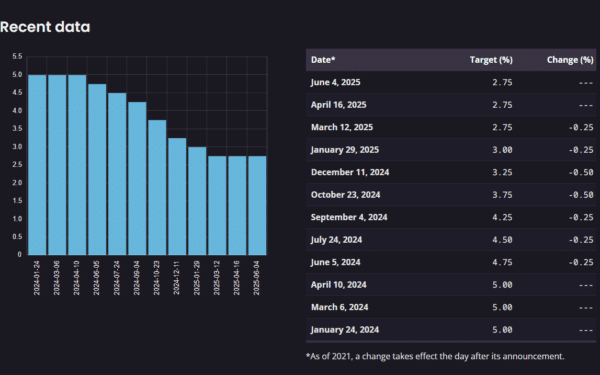

The Bank of Canada has just announced its latest interest rate decision—and it’s a hold. On June 4, 2025, the central bank maintained its overnight rate target at 2.75%, with the Bank Rate at 3% and the deposit rate at 2.70%.

This announcement is critical for anyone involved in Ontario real estate—whether you’re buying your first home, selling property, or investing. But unlike headlines that focus on inflation or uncertainty, we’re here to show you the positive side of this announcement, especially for Ontario’s housing market.

📌 Table of Contents

Quick Summary of the June 2025 Interest Rate Announcement

Here’s what you need to know from the Bank of Canada’s official statement:

-

Overnight rate held at 2.75%

-

Bank Rate is 3%, Deposit Rate is 2.70%

-

Canada’s Q1 GDP grew by 2.2%, stronger than expected

-

CPI inflation dropped to 1.7% in April, helped by the removal of the federal carbon tax

-

Unemployment rose to 6.9%, particularly in trade-related industries

-

Housing activity declined, mainly due to a sharp fall in resales

-

The global economy remains uncertain, especially due to U.S. tariffs and trade volatility

Despite global uncertainty, Canada’s economy is still resilient, and the Bank is proceeding with caution, waiting for more clarity on U.S. trade policy and inflation trends.

👉 What’s the message? The Bank of Canada isn’t rushing into further cuts or hikes—they’re giving the market time to adjust and stabilize.

What This Means for Ontario Real Estate

Ontario’s real estate market is sensitive to interest rates—but not in the way many fear.

While some housing activity declined in Q1, Ontario’s market is bouncing back quickly:

📊 In Toronto, home sales rose by 8.4% in May, the strongest monthly growth in four months.

📉 Though resales fell early in the year, this was likely a temporary dip due to buyer hesitation amid policy uncertainty.

💰 Now, with rates steady and inflation cooling, buyer confidence is rebounding—and that’s good news for everyone.

Positive Market Trends to Watch

Despite mixed headlines, these trends show why the Ontario real estate market is on the rise:

1. 🧭 Buyer Confidence Is Returning

A stable policy rate gives buyers clarity and certainty—fueling demand.

2. 🧳 Immigration Keeps Driving Demand

Ontario remains a top destination for new Canadians, pushing demand for homes and rentals.

3. 🧾 Mortgage Rates Remain Competitive

With no hike and potential cuts ahead, banks are offering strong fixed and variable options.

4. 🧱 Developers Are Re-engaging

Expect more pre-construction launches across GTA, Niagara, and Windsor, improving supply.

5. 🏘️ Rental Markets Are Strong

With high demand and low vacancy rates, rental properties are lucrative for investors.

Why Now Might Be the Best Time to Buy or Invest

You’ve heard the saying: “Don’t wait to buy real estate. Buy real estate and wait.”

That’s especially true in 2025, and here’s why:

-

Stable interest rates provide predictable monthly payments

-

Inflation is easing, making long-term investment safer

-

Housing prices are recovering, but still below peak levels

-

More listings are entering the market, increasing options for buyers

-

Rental income potential is high, especially in major cities and college towns

If you’re planning to upgrade, downsize, invest, or even buy your first home—now may be your window before prices climb further.

Frequently Asked Questions (FAQs)

1. How does the Bank of Canada’s decision affect my mortgage rate?

If you have a variable-rate mortgage, your rate remains stable for now. For those on fixed rates, today’s announcement signals confidence in the market—meaning we’re unlikely to see major rate spikes soon. Lenders will continue offering competitive products, especially as inflation cools.

2. Will Ontario home prices rise because of the rate hold?

While it’s not guaranteed, stable interest rates encourage buyer activity, which typically pushes prices upward. With steady immigration, low housing supply, and increased buyer confidence, Ontario markets like Toronto, Mississauga, and Hamilton are already seeing renewed momentum.

3. Is it smart to invest in real estate during uncertain economic times?

Yes—real estate is a tangible, inflation-resistant asset. Even amid global uncertainty (e.g., U.S. trade tensions), Canadian real estate remains a safe long-term investment. Rental demand is rising, and property values are expected to trend upward in high-demand regions.

4. What types of properties are best to invest in right now?

We’re seeing strong performance in duplexes, triplexes, condos, and suburban detached homes. These cater to both growing families and investors seeking passive income. Cities like Brampton, Oshawa, and Kitchener are offering great value and future growth potential.

5. What’s the Bank of Canada watching before the next rate change?

The Bank is closely monitoring:

-

U.S. tariffs and their impact on Canadian exports

-

Business investment and employment trends

-

How quickly cost increases pass to consumers

-

Inflation expectations and consumer spending habits

The next rate announcement is scheduled for July 30, 2025.

Final Thoughts

Today’s interest rate announcement sends a clear signal: the Bank of Canada is focused on economic stability, and Ontario’s real estate market is responding positively.

For buyers, sellers, and investors alike, this is an ideal time to re-enter the market or explore new opportunities. Whether you’re looking for your dream home or seeking a high-yield rental investment—the time to act is now.

📞 Have questions?

Contact Team Arora—your trusted Ontario real estate experts.

We’re here to help you make smart, confident moves in 2025.

📚 Sources:

-

Bank of Canada Press Release

Read Full Release -

Reuters – Toronto home sales report

Link -

Wall Street Journal – Core inflation outlook

Link