When Maya Patel decided to sell her suburban home in Mississauga, she didn’t know where to begin. The garden was a little overgrown, the paint was a tad faded, and her inbox was flooded with advice from every corner of the internet. “Stage your home!” one article screamed. “Go off-market for a better deal!” said another. Overwhelmed, she almost gave up.

But then she stumbled upon something different—not a guide, not a checklist—but a simple phrase from a local real estate blog: “The Sold Success Formula.” And while it sounded like a marketing slogan, it turned out to be the invisible compass that helped her close the deal smoothly, confidently, and profitably.

Here’s how Maya’s journey unfolded, and how the same formula might quietly guide your own selling story too.

🧭 Step One: Understanding the Market (Not Guessing It)

Maya’s first instinct was to price her home based on what her neighbor’s house had sold for last year. It had the same layout, similar square footage, and—most importantly—a backyard pool.

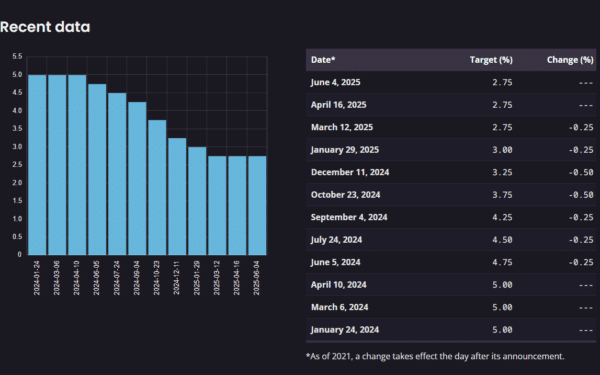

But her agent gently redirected her focus. Instead of relying on one-off sales, they conducted a comparative market analysis rooted in current data, not outdated assumptions.

Understanding the micro-market—homes of similar type, style, and age within a few blocks—became the first variable in her sold success formula. It wasn’t about pricing to sell fast or high. It was about pricing to compete and attract.

🛠️ Step Two: Prepping Like a Pro

Maya wasn’t planning on repainting. Or fixing the slightly warped front steps. But her real estate advisor explained that buyers often judge within the first eight seconds of viewing a property. The cost of a repair now often saves five times its value in final negotiations.

So she rolled up her sleeves—literally—and took care of minor cosmetic fixes, decluttered every room, and even hired a stager who transformed the guest bedroom into a cozy home office (a post-2020 dream).

That’s the second layer of the formula: presenting the property as a lifestyle upgrade, not just a house for sale.

The goal wasn’t perfection. The goal was perception.

📸 Step Three: Marketing with Method, Not Just Momentum

When the listing went live, Maya noticed something striking. The photos weren’t just pictures—they were scenes. The sunlit kitchen shot was timed for golden hour. The backyard looked like a summer magazine spread. The headline didn’t say “3-bedroom home in Mississauga.” It said: “Where Work-from-Home Feels Like a Weekend.”

The listing went out across local real estate sites, social media, buyer newsletters, and targeted Facebook campaigns. Every channel spoke to a different type of buyer, not a generic mass.

That’s the third part of the formula: precision marketing. It’s not about more visibility—it’s about the right visibility.

🗣️ Step Four: Communication is Negotiation in Disguise

When the first offer came in, Maya was thrilled. But her agent didn’t react—not yet. Instead, they reviewed it objectively, weighed the pros and cons, and reached back out with a gentle counteroffer that maintained momentum without seeming too eager.

Three other offers followed, two of them with emotional letters from potential buyers. Maya chose not just the highest bid—but the strongest overall terms.

Throughout it all, her agent stayed calm, communicative, and strategic. That’s the fourth piece: negotiating with insight, not emotion.

🎯 The Sold Success Formula—In Summary

Though Maya never saw it written down, her journey revealed the quiet backbone of successful home sales. The Sold Success Formula can be thought of as:

Market Understanding + Strategic Preparation + Targeted Marketing + Negotiation Mastery = A Confident, Profitable Sale

No gimmicks. No hype. Just method, mindset, and a little magic called consistency.

🧾 Final Thoughts

Maya’s home didn’t sell overnight. It didn’t go viral. But it sold above asking—because it followed a system, not a shortcut.

The real estate world is full of noise. But sellers who follow a tested, data-driven process often find that success isn’t loud. It’s logical.

❓ FAQs About the Sold Success Formula

Q1: What makes the Sold Success Formula different from traditional real estate advice?

The Sold Success Formula isn’t about buzzwords or trendy tactics. It’s a holistic, step-by-step mindset that treats every listing like a strategic product launch—not just a transaction. While traditional advice often focuses on isolated elements (like curb appeal or pricing alone), this formula ties together market analytics, preparation, marketing, and negotiation into one cohesive path.

It doesn’t guarantee a bidding war or instant sale, but it significantly increases the odds of a well-timed, well-priced offer that aligns with the seller’s expectations.

Q2: Can this formula work for any type of property—condos, detached homes, or rural listings?

Absolutely. While each property type has unique challenges, the principles remain the same. For instance:

- A downtown condo may require different staging priorities and urban-targeted marketing.

- A rural property may need drone photography and community-based outreach.

- A heritage home might require emphasizing its unique history.

The framework stays the same, but the execution adapts based on the property’s strengths, location, and buyer persona.

Q3: Is the Sold Success Formula something homeowners can apply themselves?

Some parts, yes. Homeowners can absolutely take initiative on home prep, understanding market trends via public data, and maintaining clear communication with agents and buyers.

However, the real power of the formula lies in professional execution. For example, access to hyper-local market comparables, professional staging, expert copywriting, and tactical negotiation techniques usually come from seasoned agents and marketing teams.

Think of it like baking a cake. You might have the ingredients, but the difference between homemade and bakery-quality is all in the technique.

Q4: What happens if a home doesn’t sell even after applying this formula?

Great question. The Sold Success Formula is not a silver bullet—it’s a strategic compass. If a home isn’t selling, the formula encourages sellers to diagnose, not panic.

That means asking:

- Is the pricing still in line with current buyer behavior?

- Is the marketing reaching the right audience—or just the most obvious one?

- Is the property’s presentation aligned with the emotional triggers of today’s buyers?

The formula includes adaptation as a core value, not just launch-and-leave tactics. Sometimes, a small pivot (in photos, price range, or buyer targeting) can reignite momentum.

Q5: How long does it usually take for the Sold Success Formula to work?

There’s no one-size-fits-all timeline. Some homes align perfectly with seasonal trends and sell within days. Others, especially niche properties or those in slower markets, might require weeks of careful calibration.

However, properties that follow this formula often sell closer to the asking price and with fewer surprises during the closing phase. Time may vary, but quality of offer and transaction stability are key benefits.