The accounting industry is the backbone of financial transparency and compliance across businesses, individuals, and nonprofit organizations. In the United States, accounting firms and Certified Public Accountants (CPAs) not only handle audits and tax filings but also provide critical financial guidance that drives decision-making for organizations of all sizes.

This blog offers a comprehensive look into the Accounting Services industry, exploring its growth, challenges, valuation, and future outlook.

Understanding the Industry

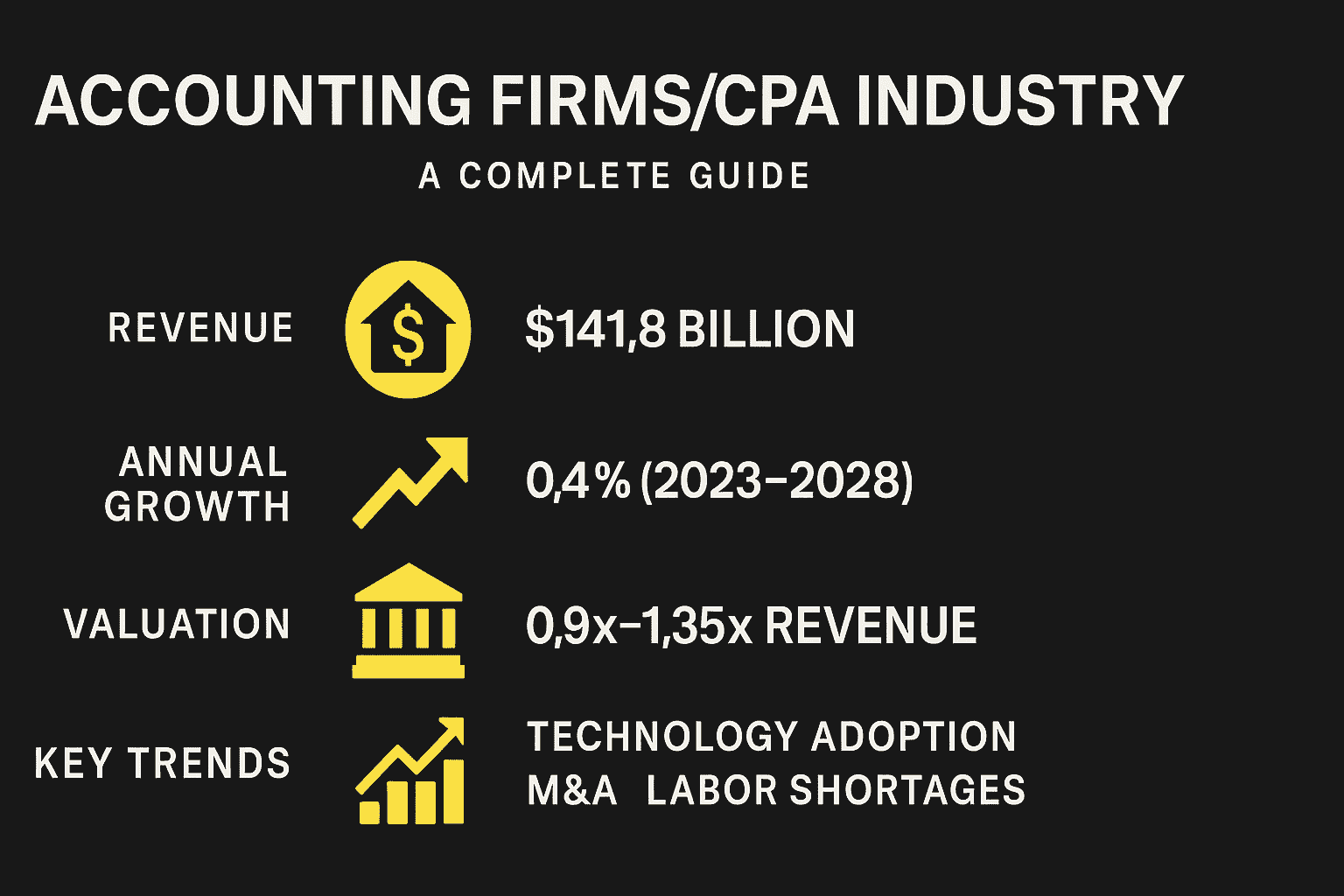

The U.S. accounting industry is large and stable. According to the Business Reference Guide (BRG), there are approximately 95,559 establishments, generating around $141.8 billion in annual revenue. Collectively, firms employ nearly 823,000 workers with wages exceeding $54.2 billion.

These firms specialize in:

-

Financial auditing (36.6%)

-

Corporate tax preparation (26.8%)

-

Individual tax preparation (16.1%)

-

Other advisory services including payroll, financial planning, and consulting (20.5%)

This industry is highly regulated and requires strict compliance with auditing standards, tax laws, and professional ethics.

Industry Performance and Growth

Between 2018 and 2023, the accounting services sector grew by 3.4% annually. Looking ahead, the BRG projects a modest growth rate of 0.4% through 2028. While growth is slower compared to other industries, the accounting sector remains resilient because:

-

Every business and individual is required to file tax returns.

-

Demand for audits and compliance is ongoing.

-

The industry generates recurring annual revenue, making it less sensitive to market downturns.

Valuation and Financial Benchmarks

When it comes to acquisitions and investments, accounting firms are typically valued using multiples of revenue or earnings.

-

Small Firms (< $1M revenue): valued around 0.96x Net Sales

-

Mid-sized Firms ($1–5M): valued between 0.88–0.92x Net Sales

-

Larger Firms (metro areas): valued at 1.0–1.35x annual gross revenue

-

EBITDA multiples: ~ 2.2x

These valuations reflect the recurring, stable revenue streams that accounting firms generate, particularly from tax services and long-term client relationships.

Market Segmentation

The client base for accounting firms is diverse:

-

Finance sector: 21.7%

-

Individuals: 19.5%

-

Other businesses/industrial: 14.3%

-

Retail sector: 11%

-

Manufacturing: 8%

-

Nonprofit organizations: 5.3%

This segmentation highlights the industry’s widespread role in supporting multiple sectors of the economy.

Industry Trends

The industry is undergoing significant transformation, driven by technology, demographics, and market consolidation.

-

Technology Adoption – Firms are shifting to cloud-based software, automation, and AI tools, reducing reliance on manual accounting. This not only cuts costs but also allows accountants to focus on advisory services.

-

Mergers and Acquisitions – Larger firms are expanding into wealth management and insurance, while smaller firms are being acquired or consolidated.

-

Aging Workforce – Many CPAs are nearing retirement, creating a shortage of qualified professionals and driving demand for younger accountants.

-

Outsourcing – Offshore accounting and outsourced back-office functions are becoming more common, particularly for smaller firms under pressure to keep costs low.

-

Regulatory Changes – Ongoing tax law updates and regulatory adjustments continue to fuel demand for professional accounting services.

Strengths of the Industry

-

Resilient During Recessions: Even during economic downturns, tax filing and audits remain necessary.

-

Recurring Revenue: Annual tax filing and compliance work create steady income.

-

Cross-Selling Opportunities: Firms can expand into payroll, consulting, and financial advisory.

-

Trusted Client Relationships: CPAs hold a high level of trust with clients, fostering loyalty and repeat business.

Challenges Facing Accounting Firms

-

Competition from Low-Cost Providers: Online tax platforms and software alternatives are pressuring traditional firms.

-

Talent Shortage: Recruiting and retaining skilled CPAs is increasingly difficult.

-

Price Pressure: Smaller firms often cut fees to remain competitive, lowering profitability.

-

Regulatory Uncertainty: Frequent changes in tax laws make planning challenging.

Opportunities for Growth

Despite the challenges, accounting firms can tap into several opportunities:

-

Expand into Wealth Management & Insurance – Bundling accounting with financial planning services.

-

Leverage Technology – Automating basic tasks and focusing on higher-value advisory services.

-

Consolidation – Merging smaller CPA firms to create stronger, more competitive practices.

-

Advisory Services – Helping clients with strategy, compliance, and risk management beyond tax filing.

Financing & Acquisitions

Most acquisitions in this industry are financed with a mix of bank loans and seller financing:

-

80% bank loans + 20% seller financing are common.

-

SBA loans are widely used, particularly for smaller firms.

-

Larger practices tend to attract conventional financing.

This financing flexibility, combined with stable revenue streams, makes CPA firms attractive acquisition targets.

FAQs About Accounting Firms and the Industry

1. Why are accounting firms considered recession-proof?

Accounting services are driven by compliance requirements rather than market cycles. Regardless of economic conditions, individuals and businesses must file taxes, prepare financial statements, and undergo audits. This recurring demand ensures firms remain busy even during downturns. While profit margins may tighten, revenues tend to stay stable, making the industry more recession-resistant compared to other sectors.

2. How are accounting firms valued for sale?

Valuation usually depends on annual revenue, profitability, and location. Small firms in rural areas might sell for 100% of annual revenue, while well-established metro firms can fetch up to 135% of revenue. EBITDA multiples average around 2.2x. Other factors such as client base, staff expertise, and growth potential also play a major role in determining value.

3. What challenges do small CPA firms face?

Small firms often struggle with staffing shortages, client retention, and fee pressure. Many are forced to lower their prices to compete with large firms or online platforms, which reduces profitability. Additionally, small owners often face time pressure during tax season, making it harder to balance operations and growth.

4. How is technology changing the accounting industry?

Technology is revolutionizing the way firms operate. Cloud accounting platforms, AI-powered bookkeeping tools, and automation are reducing manual data entry and compliance tasks. This allows accountants to focus on advisory services such as financial planning and consulting. Firms that adopt these tools gain efficiency and improve client satisfaction, while those that don’t risk being left behind.

5. What makes accounting firms attractive to buyers?

From an investment perspective, accounting firms are attractive because they:

-

Offer predictable, recurring annual revenue.

-

Provide opportunities to cross-sell financial services.

-

Have long-term client relationships built on trust.

-

Operate in a regulated, stable industry.

These factors make them a low-risk investment compared to industries that are heavily cyclical or dependent on consumer spending.

6. What is the future outlook for the industry?

While growth will be slow (0.4% annually through 2028), the accounting industry will remain steady. Demand for advisory services, mergers and acquisitions, and technology-driven efficiencies will define the future. However, competition from online tax software and staffing shortages may pose challenges. Firms that adapt to these changes will thrive, while others may consolidate or exit.

The Accounting Services industry plays a critical role in financial transparency, compliance, and advisory services. With a strong base of recurring revenue, steady demand, and opportunities for expansion into advisory and financial planning, the industry is well-positioned for long-term resilience.

While growth will be modest, the need for qualified CPAs will remain strong. Firms that embrace technology, expand services, and strategically consolidate will be the ones to succeed in the years ahead.

Citation

Business Brokerage Press. Business Reference Guide: Accounting Firms/CPAs Industry Overview. 2023.

industry_overview Business Reference Guide

All data and statistics in this article are provided for informational purposes only. We are not claiming the exactness of numbers, as industry figures may vary depending on source, location, and market changes. Readers should use this information as a general guide and consult a licensed professional or verified reports for precise details.