In 2023, the Florida real estate market experienced a series of fluctuations that caught the attention of both domestic and international investors, particularly those hailing from Canada. As we navigate through the present, it’s essential to take a closer look at the trends that defined the past year and how they compare to the current dynamics of the market.

2023: A Year of Adaptation and Growth

The year 2023 was marked by a resilient Florida real estate market that adapted to the challenges posed by economic uncertainties, interest rate adjustments, and evolving consumer preferences. Amid these factors, the market showcased notable growth areas, particularly in the residential sector, where demand for single-family homes and condos remained strong among buyers seeking vacation homes, investment properties, and permanent residences.

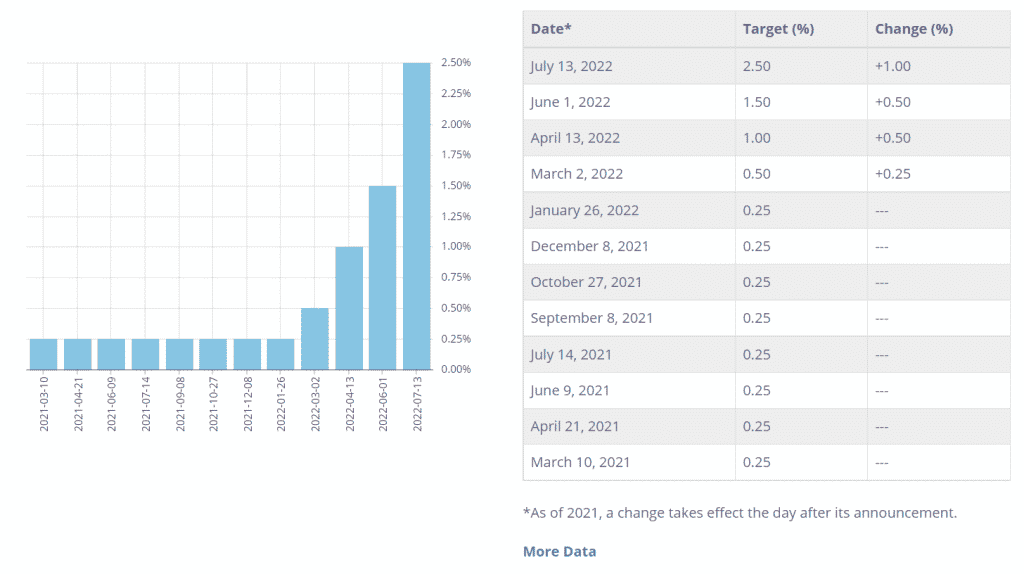

Interest Rates and Market Dynamics

One of the defining factors of 2023 was the fluctuation in interest rates, which impacted buyer affordability and investment strategies. Despite these challenges, Florida’s market demonstrated robustness, partly due to its appeal to a diverse demographic of buyers, including retirees, remote workers, and international investors, particularly Canadians looking for a warm escape or investment opportunity.

Migration Trends and Demand

Florida continued to benefit from significant migration trends, with individuals and families moving from colder climates and more congested urban centers to enjoy the state’s favorable weather, tax advantages, and lifestyle benefits. This migration contributed to sustained demand in both the residential and commercial sectors, driving growth in new construction and increasing competition for prime properties.

Present Trends: Continuity and New Opportunities

As we look at the present, several trends from 2023 continue to shape the Florida real estate market, while new opportunities and challenges emerge. The demand for residential properties remains strong, buoyed by Florida’s ongoing appeal to a broad audience, including a significant number of Canadian investors and homebuyers.

Market Resilience and Investment Opportunities

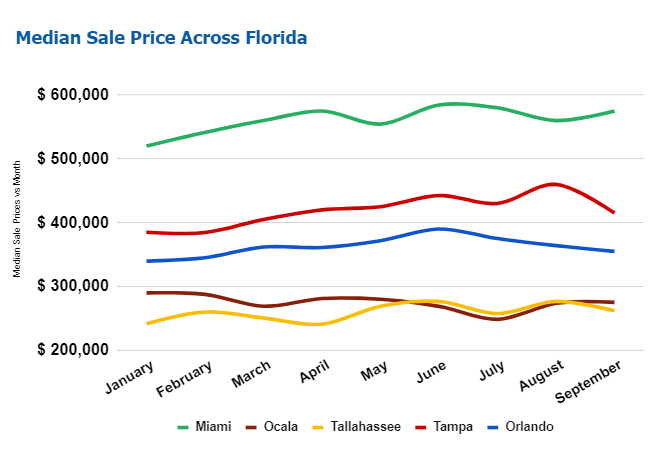

The Florida real estate market has shown remarkable resilience, with sustained interest from buyers and investors. The state’s economic fundamentals remain strong, supported by a growing population, increasing employment opportunities, and a vibrant tourism industry. For Canadians, Florida presents an attractive investment landscape, offering potential for capital appreciation and rental income, particularly in sought-after areas such as Miami, Orlando, Tampa, and the Gulf Coast.

Evolving Consumer Preferences

Consumer preferences continue to evolve, with a growing emphasis on sustainability, smart home technology, and communities offering a blend of residential and commercial amenities. Developers and builders are responding to these trends by incorporating green building practices, energy-efficient features, and mixed-use developments that cater to the lifestyle demands of today’s buyers.

FAQs for Canadian Investors

Q: How do interest rates in the U.S. affect Canadian investors in the Florida real estate market?

A: U.S. interest rates can impact financing costs for Canadian investors. Higher rates may increase borrowing costs, while lower rates can make financing more affordable. It’s crucial to monitor these trends and consider the impact on investment returns.

Q: What are the tax implications for Canadians buying property in Florida?

A: Canadians owning property in Florida must consider both U.S. and Canadian tax implications, including property taxes, potential rental income taxes, and estate taxes. Consulting with a tax professional experienced in cross-border taxation is advisable.

Q: Can Canadians obtain financing for Florida real estate purchases?

A: Yes, Canadians can obtain financing, but the process may involve additional documentation and higher down payment requirements compared to U.S. citizens. Working with lenders experienced in serving international clients can streamline this process.

The Florida real estate market has proven to be dynamic and resilient, offering numerous opportunities for Canadian investors and homebuyers. While 2023 was a year of adaptation and growth, the present market continues to evolve, shaped by ongoing demand, economic fundamentals, and changing consumer preferences. For Canadians looking to invest or relocate, Florida remains an attractive destination, offering a combination of lifestyle benefits, investment potential, and a welcoming environment for international buyers.

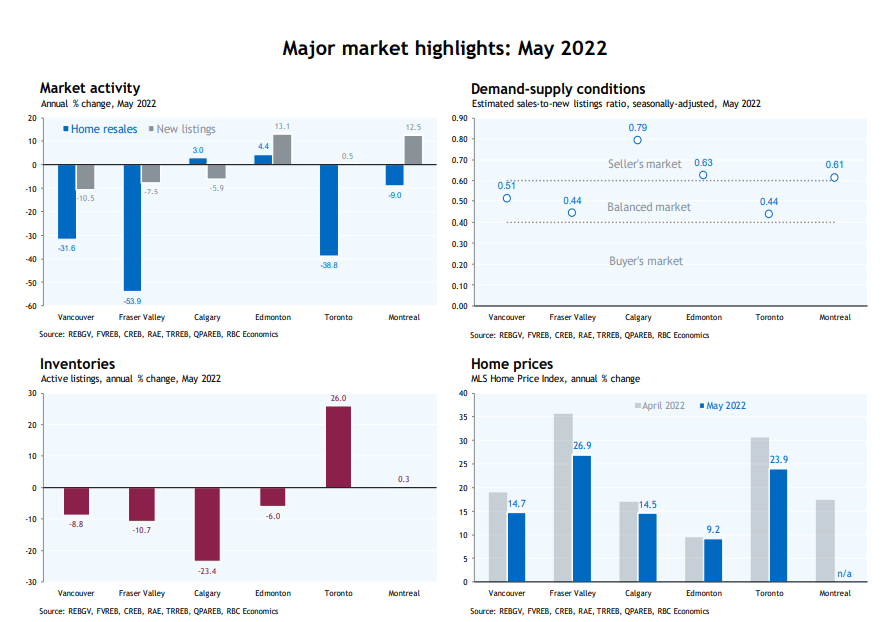

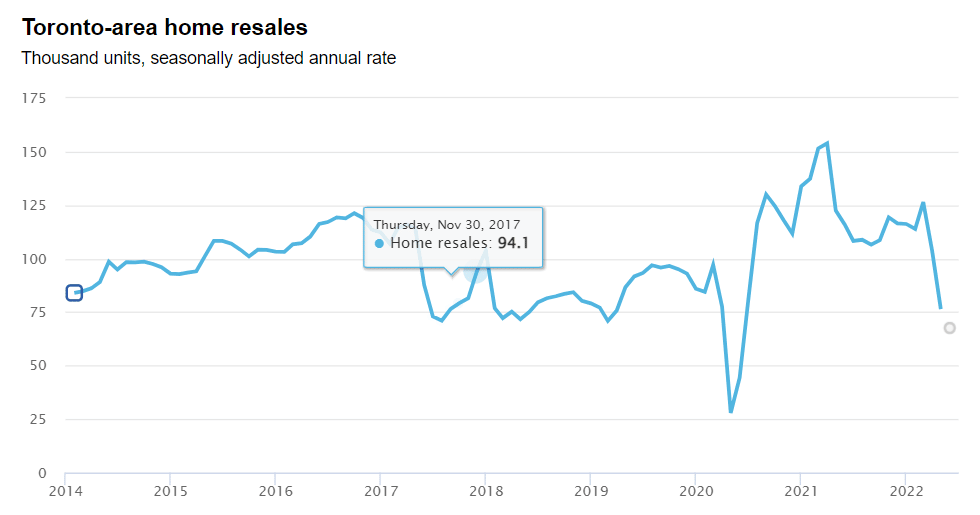

Source: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics | *Yellow dot indicates estimate for May 2022

Source: Canadian Real Estate Association, Toronto Region Real Estate Board, RBC Economics | *Yellow dot indicates estimate for May 2022